Introducing Inflation and Contribution Volatility in 2024

One of the most pressing issues in retirement planning is managing the impact of inflation on contribution volatility in 2024. Inflation, which has been a persistent challenge in the U.S. economy, directly affects the stability of retirement funds. In turn, this volatility can significantly impact the retirement savings of millions of Americans. In this blog, we’ll explore how inflation and contribution volatility in 2024 are intertwined, their implications for

retirement planning, and strategies for managing these challenges in 2024.

What is Inflation and Contribution Volatility in 2024?

Understanding Inflation and its Impact on Retirement Planning

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. In the context of retirement planning, inflation can drastically reduce the real value of retirement savings over time. For instance, an inflation rate of 3% may seem modest, but over 20 years, it can reduce the purchasing power of your savings by almost half.

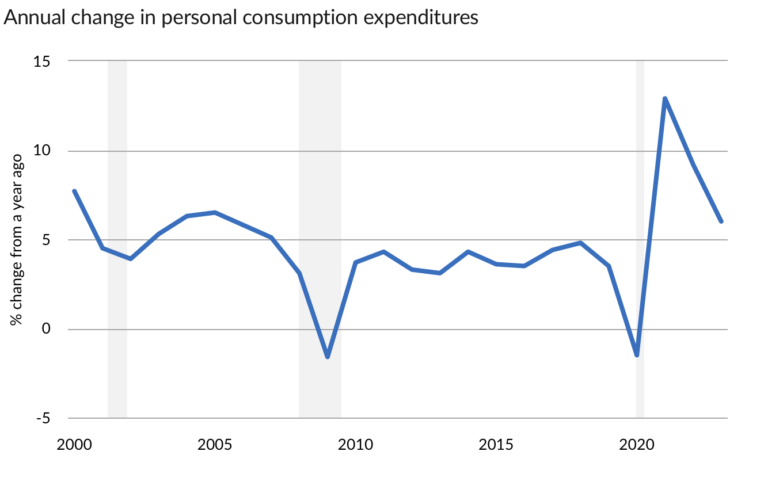

In 2024, inflation remains a critical concern for both retirees and those still in the workforce. The recent volatility in inflation rates—peaking at over 9% in 2022 and stabilizing to around 3.4% by late 2023—highlights the unpredictability of the economic environment. This unpredictability is a significant factor in the conversation about “Inflation and Contribution Volatility in 2024 Retirement Planning.”

In 2024, inflation remains a critical concern for both retirees and those still in the workforce. The recent volatility in inflation rates—peaking at over 9% in 2022 and stabilizing to around 3.4% by late 2023—highlights the unpredictability of the economic environment. This unpredictability is a significant factor in the conversation about “Inflation and Contribution Volatility in 2024 Retirement Planning.”

Contribution Volatility: A Consequence of Inflation

Contribution volatility refers to the fluctuations in the amount that needs to be contributed to maintain a pension plan’s funding status. When inflation rises, it often leads to increased volatility in required contributions. This is because inflation can affect the assumed rates of return on investments, which are crucial in determining how much needs to be set aside each year to meet future obligations.

In 2024, managing “Inflation and Contribution Volatility in 2024 Retirement Planning” is particularly challenging due to the mixed signals from the economy. On one hand, the Federal Reserve’s efforts to control inflation have led to higher interest rates, which can increase the discount rate used in pension plan calculations. On the other hand, the volatile stock market has made it difficult for pension funds to achieve consistent returns, leading to greater uncertainty in contribution requirements.

In 2024, managing “Inflation and Contribution Volatility in 2024 Retirement Planning” is particularly challenging due to the mixed signals from the economy. On one hand, the Federal Reserve’s efforts to control inflation have led to higher interest rates, which can increase the discount rate used in pension plan calculations. On the other hand, the volatile stock market has made it difficult for pension funds to achieve consistent returns, leading to greater uncertainty in contribution requirements.

Strategies to Mitigate Inflation and Contribution Volatility in 2024

Given the significant impact of inflation on contribution volatility in 2024, it’s essential for

retirement plan sponsors

to adopt strategies that can help mitigate these risks. Here are some approaches that can be effective in 2024:

Diversifying Investment Portfolios

One way to manage contribution volatility is to diversify the investment portfolio of the pension plan. By investing in a mix of asset classes—such as equities, bonds, real estate, and alternative investments—plan sponsors can reduce the risk associated with any single asset class. This diversification can help stabilize returns, even in the face of inflation-induced market volatility.

Adjusting Contribution Rates

Another strategy is to adjust contribution rates dynamically based on current economic conditions. For example, during periods of high inflation, increasing contributions can help maintain the plan’s funded status. Conversely, during periods of low inflation, contribution rates can be reduced, easing the financial burden on employers.

Re-evaluating Assumed Rates of Return

Given the uncertainty in the market, it may be prudent for plan sponsors to re-evaluate their assumed rates of return. By adopting more conservative assumptions, plans can avoid the risk of underfunding and reduce the need for sudden increases in contributions.

Implementing Inflation-Linked Securities

Pension plans can also invest in inflation-linked securities, such as Treasury Inflation-Protected Securities (TIPS). These securities provide returns that are adjusted for inflation, ensuring that the purchasing power of the plan’s assets is preserved. Incorporating TIPS into the portfolio can be an effective way to hedge against inflation and reduce contribution volatility.

The Role of Regulatory Changes

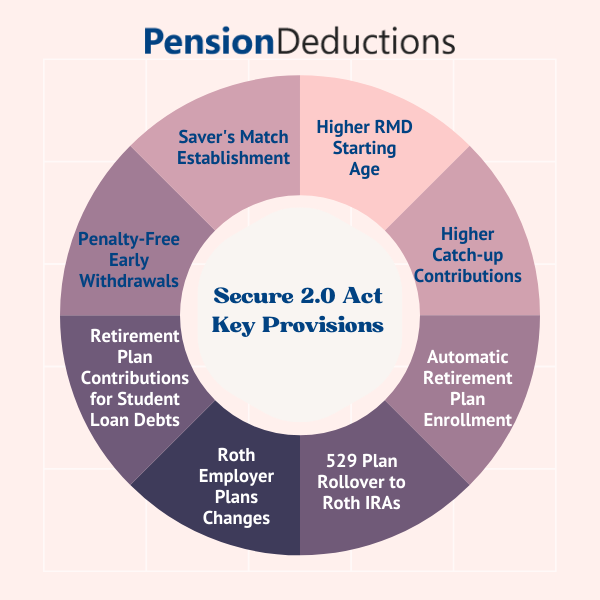

In 2024, regulatory changes are also playing a significant role in how “Inflation and Contribution Volatility in 2024 Retirement Planning” is managed. The SECURE 2.0 Act, for instance, introduces several provisions aimed at enhancing retirement security, which could influence how

employers and plan sponsors

approach these challenges.

One key provision is the requirement for more transparent disclosure of pension plan assumptions, including the inflation rate and the assumed rate of return. This increased transparency can help participants better understand the risks associated with their retirement plan and make more informed decisions.

Moreover, the Department of Labor is considering updates to its guidelines on pension risk management, which could further impact how contribution volatility is handled. These regulatory developments underscore the importance of staying informed and adapting to the changing landscape of retirement planning.

One key provision is the requirement for more transparent disclosure of pension plan assumptions, including the inflation rate and the assumed rate of return. This increased transparency can help participants better understand the risks associated with their retirement plan and make more informed decisions.

Moreover, the Department of Labor is considering updates to its guidelines on pension risk management, which could further impact how contribution volatility is handled. These regulatory developments underscore the importance of staying informed and adapting to the changing landscape of retirement planning.

Looking Ahead: Preparing for the Future

As we move further into 2024, it’s clear that “Inflation and Contribution Volatility in 2024 Retirement Planning” will continue to be critical issues for plan sponsors and participants alike. The uncertainty in the economic environment, coupled with ongoing regulatory changes, means that proactive planning and risk management will be more important than ever.

For employers and plan sponsors, the focus should be on adopting strategies that can withstand economic volatility and protect the long-term interests of plan participants. By diversifying investments, adjusting contributions, and staying informed about regulatory developments, it’s possible to navigate the challenges of inflation and contribution volatility effectively.

For participants, understanding how inflation affects their retirement savings is crucial. Staying informed about the health of their retirement plan, and making adjustments to their own savings strategies as needed, can help ensure that they are well-prepared for the future.

For employers and plan sponsors, the focus should be on adopting strategies that can withstand economic volatility and protect the long-term interests of plan participants. By diversifying investments, adjusting contributions, and staying informed about regulatory developments, it’s possible to navigate the challenges of inflation and contribution volatility effectively.

For participants, understanding how inflation affects their retirement savings is crucial. Staying informed about the health of their retirement plan, and making adjustments to their own savings strategies as needed, can help ensure that they are well-prepared for the future.

Conclusion

In 2024, managing the challenges of inflation and contribution volatility is essential for anyone involved in retirement planning. Whether you’re an employer, plan sponsor, or individual participant, understanding the relationship between these two factors and adopting strategies to mitigate their impact is key to securing a stable and prosperous retirement.

SHARE THIS POST

Related Blogs

Generation X and Retirement

Read More »

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Shrideep Murthy

April 7, 2025

9:15 pm

Defined Benefit Plan vs 401k: Best Pension Plans for Small Business Owners

Read More »

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Shrideep Murthy

February 25, 2025

2:48 pm

How Small Business Owners Can Save Up to $300,000 in Taxes with a Pension Plan

Read More »

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Shrideep Murthy

February 17, 2025

9:15 pm

The Ultimate Guide to Using a Cash Balance Plan Calculator in 2025

Read More »

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Shrideep Murthy

January 28, 2025

10:05 pm