There are several retirement plans out there in the market, and each one is more complicated than the other. Selecting the best plan for yourself and your firm is no easy task and it often leads to frustration.

To make the task easier, we narrow it down to just two variables that are crucial in the decision-making process. These are:

- Employees: Does your business have employees (Yes/No)?

- Free Cash Flow: How much money are you looking to put aside in a retirement plan for yourself? Similarly, how much money are you comfortable contributing towards your employee retirement plan?

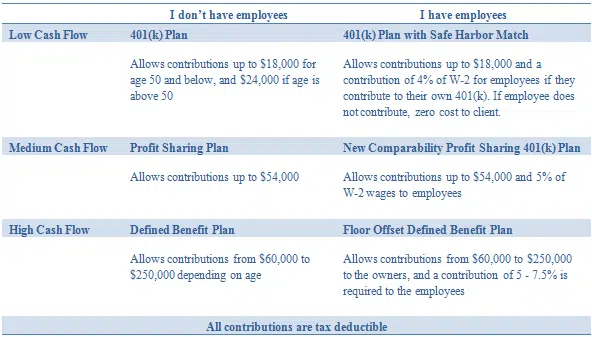

The table below gives an overview of retirement plans. Just select the appropriate box you identify yourself in and read about the right plan for you. All contributions to a retirement plan are tax deductible, so expect some savings on your taxes as well.

If you don’t have employees, the following plans based on your cash flow can prove to be the right choice for you-

- Low Cash Flow: In this situation you can opt for the solo/individual 401(k) plan. People under 50 can make contributions of up to $18,000 and those above the age of 50 can make an additional $6,000 contribution adding to a total of $24,000. These limits are adjusted annually by the IRS based on the cost of living increases.

- Medium Cash Flow: Regardless of the size of the business, profit sharing plan is a good plan for a business with medium cash flow or inconsistent cash flow. It allows clients to contribute up to $54,000 annually and provides flexibility in choosing the amount of contributions in any given year. This plan can be beneficial if the company employs the spouse as well and contributions can be made for the spouse, thereby increasing the total amount of contributions.

- Largest Cash Flow: With a high cash flow, you can always go for a single life Defined Benefit Plan. Defined Benefit Plans depend on the age and the compensation of the individual and can allow contributions from 60,000 to 250,000 in some situations. You can use our defined benefit calculator to estimate the amount of contributions in the first year.

If you have employees, the IRS makes it mandatory that you provide retirement benefits for them as well. However, the IRS gives significant leeway in allowing the business owners to accumulate higher retirement benefits and provide only the required benefits for the employees. This also means that there are certain compliance tests that need to be done in the retirement plan each year. Based on the criteria discussed earlier, there can be three options for a business with employees.

- Low Cash Flow: Clients can select a 401(k) plan with safe harbor provisions. This plan allows contribution of up to $18,000 for the business owner, and an additional 4% of W-2 compensation. If the business owner is above the age of 50, a catch up contribution of $6,000 can be made. This plan also eliminates some of the mandatory compliance tests and makes the administration very smooth. If the client has low but consistent cash flow, then the safe harbor option is the better choice.

There are two variations of a safe harbor plan:

- 401(k) Plan with Safe Harbor match: For the employees that contribute to their own 401(k), employers ‘match’ 100% the employees’ contributions up to 4% of their compensation. This is the more popular option. This basically means that clients have to contribute only to those employees who defer to the 401(k). If none of the employees defer to the 401(k), no contribution has to be made to the employee retirement plan.

- 401(k) Plan with Safe Harbor non-elective: Irrespective of employees’ contributions, for every eligible employee, the employer contributes 3% of the employee’s compensation. This is ideal for a company where most of the people will defer to their 401(k) plans. The owner of the business can contribute the $18,000 and an additional 3% of W-2 wages for their own retirement.

- Medium Cash Flow: If the owners of the business wish to contribute more towards their own retirement plans, they can choose the New Comparability Profit Sharing Plan. This design allows contributions of up to $54,000 for the owners and a contribution of 5% of W-2 wages may be required for the employees. This plan allows the company to categorize the workers in different classes and allocate different contribution rates to them. The plan sponsor can design the plan to reward certain class of employees with a higher contribution percentage as long as it is within the limits prescribed by the IRS. The company can meet the non-discrimination requirements by setting a minimum contribution rate for all employees and carrying out Non-discrimination testing for the pension plan.

- Largest Cash Flow: The Floor Offset Defined Benefit Plan allows maximum contributions to the owners of the business and requires a contribution of 5% to 7.5% of W-2 wages towards the employees. To read about a floor offset plan in detail, please visit the floor offset plan page.

Although choosing a retirement plan may require significant time and resources, it is essential for financial security. The ideal retirement plan can help the business owner accumulate a significant amount of pre-tax wealth while providing benefits to the employees as well.