Social Security Reforms 2024

Why Social Security Needs Reform in 2024?

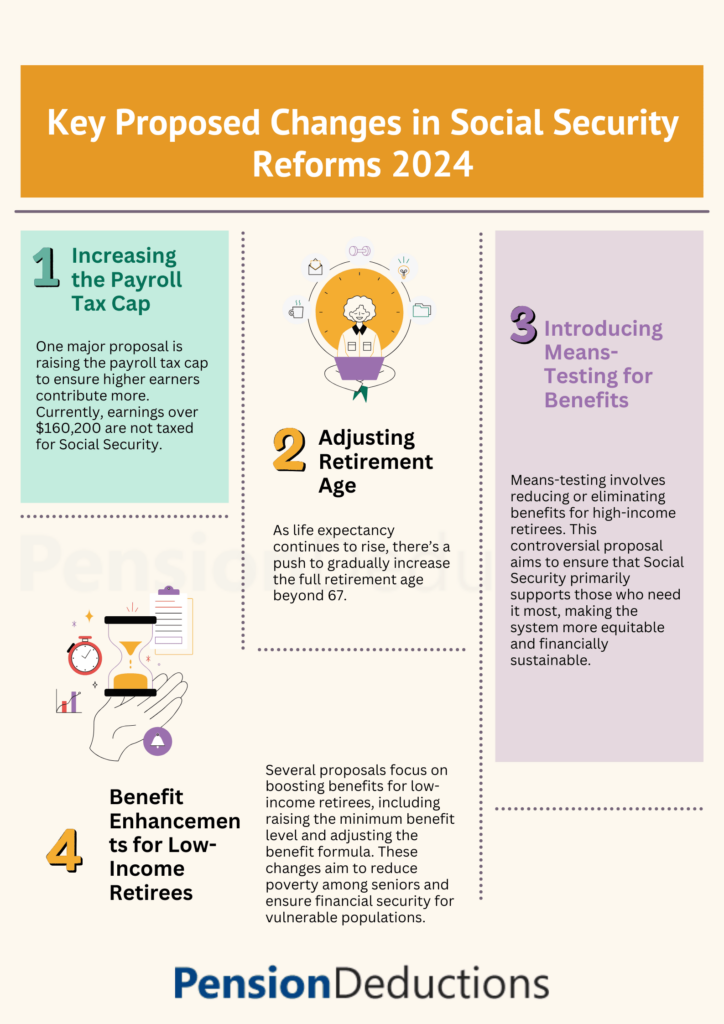

Key Proposed Changes in Social Security Reforms 2024

Increasing the Payroll Tax Cap

One major proposal is raising the payroll tax cap to ensure higher earners contribute more. Currently, earnings over $160,200 are not taxed for Social Security. Proposals suggest raising this cap or eliminating it entirely, which could significantly increase revenue and extend the system’s solvency.

Adjusting Retirement Age

As life expectancy continues to rise, there’s a push to gradually increase the full retirement age beyond 67. Proponents argue this adjustment reflects modern longevity trends and can help balance the system by reducing the length of benefit payouts.

Introducing Means-Testing for Benefits

Means-testing involves reducing or eliminating benefits for high-income retirees. This controversial proposal aims to ensure that Social Security primarily supports those who need it most, making the system more equitable and financially sustainable.

Benefit Enhancements for Low-Income Retirees

Several proposals focus on boosting benefits for low-income retirees, including raising the minimum benefit level and adjusting the benefit formula. These changes aim to reduce poverty among seniors and ensure financial security for vulnerable populations.

Impact of Social Security Reforms 2024 on Different Groups

Workers and Employers

Increased payroll taxes could mean higher deductions from paychecks for both employees and employers. While this may seem burdensome, it’s a necessary step to maintain the system’s viability. Employers will also need to adjust their payroll systems and educate employees on these changes.

Current and Future Retirees

For current retirees, these reforms could lead to modest benefit increases, especially for those in lower-income brackets. Future retirees may need to adjust their retirement timelines or savings strategies, particularly if the retirement age is raised or if means-testing is implemented.

Schedule a Free Consultation Now!

Broader Economic Implications

National Economy

Social Security reforms will have a ripple effect across the U.S. economy. Increased payroll taxes could reduce disposable income, potentially impacting consumer spending. However, ensuring the system’s solvency can provide long-term economic stability, reducing the burden on other government welfare programs.

Financial Markets

Changes to Social Security could influence investment strategies. For instance, if individuals anticipate lower benefits, they may increase personal savings or investments in retirement accounts, potentially boosting demand in financial markets.

Technological Integration and Administrative Efficiency

Public Opinion and Political Landscape

Preparing for the Future: What Can You Do?

Stay Informed

Regularly monitor updates from the SSA and trusted financial news sources.

Consult Financial Advisors

Tailor your retirement plan to account for potential changes in benefit payouts, retirement age, and tax contributions.

Boost Personal Savings

Consider increasing contributions to 401(k)s, IRAs, or other retirement accounts to offset potential reductions in Social Security benefits.

Conclusion

SHARE THIS POST

Uncover how Social Security Reforms 2024 will impact retirees with crucial changes to taxes, benefits, and retirement age adjustments.

Discover what to expect for Social Security payment 2024 in December, including key dates, COLA adjustments, and tips to ensure timely benefits.

Discover the top retirement savings tips for individuals aged 55 to 64. Learn how to maximize your 401(k), IRAs, Social Security, and pension benefits while planning for a secure future.

Explore the 2025 Social Security COLA forecast with a 2.5% increase. Learn how this adjustment affects retirees and the factors influencing this year’s forecast.