Social Security COLA 2025: What You Need to Know.

As we look ahead to 2025, one of the most critical topics for retirees and those approaching retirement in the USA is the Social Security Cost-of-Living Adjustment (COLA). The Social Security COLA 2025 is a subject of significant interest because it directly impacts the monthly benefits of millions of Americans. This article will explore what COLA is, why it’s essential, and what to expect for 2025. We’ll also discuss the broader implications of COLA on retirement planning.

What is Social Security COLA?

The Social Security Cost-of-Living Adjustment (COLA) is an annual adjustment made to Social Security benefits to ensure that these benefits keep pace with inflation. The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the average change in prices over time for a basket of goods and services. In essence, COLA helps maintain the purchasing power of Social Security benefits by adjusting them to reflect inflationary pressures.

The importance of the Social Security COLA 2025 cannot be overstated. With rising living costs, particularly in healthcare, housing, and essential services, retirees rely on COLA to preserve their standard of living. Without these adjustments, the real value of Social Security benefits would diminish over time, leaving retirees vulnerable to financial hardships.

The importance of the Social Security COLA 2025 cannot be overstated. With rising living costs, particularly in healthcare, housing, and essential services, retirees rely on COLA to preserve their standard of living. Without these adjustments, the real value of Social Security benefits would diminish over time, leaving retirees vulnerable to financial hardships.

How is the COLA for 2025 Determined?

The Social Security COLA 2025 will be determined by the Bureau of Labor Statistics, which calculates the CPI-W from the third quarter of the previous year (2024) to the third quarter of the current year (2025). The percentage increase in this index determines the COLA for the following year. If the CPI-W increases, beneficiaries receive a higher monthly payment; if it remains unchanged or decreases, there is no COLA, though benefits are never reduced.

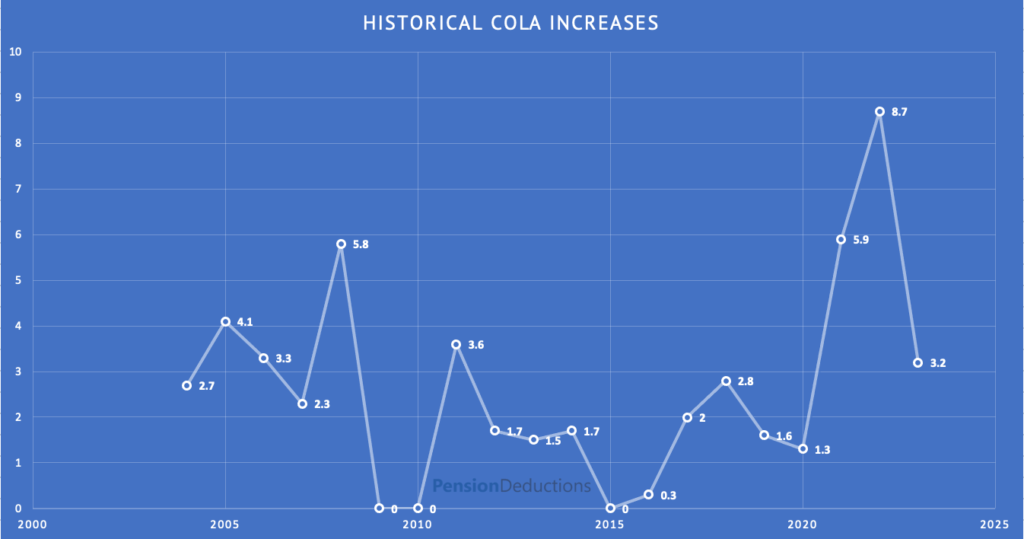

In recent years, inflation has been relatively low, leading to modest COLA increases. However, with economic uncertainties, there is speculation that the Social Security COLA 2025 could be higher than previous years. Factors such as global supply chain disruptions, rising healthcare costs, and economic policies may all influence the 2025 adjustment.

In recent years, inflation has been relatively low, leading to modest COLA increases. However, with economic uncertainties, there is speculation that the Social Security COLA 2025 could be higher than previous years. Factors such as global supply chain disruptions, rising healthcare costs, and economic policies may all influence the 2025 adjustment.

Why is Social Security COLA 2025 Important?

The Social Security COLA 2025 is crucial for several reasons:

Expectations for Social Security COLA 2025

Predicting the exact COLA for 2025 is challenging, but several factors suggest it could be higher than in recent years. These include:

Inflation Trends

If inflation continues to rise due to factors such as increased demand for goods and services, supply chain issues, or fiscal policies, the COLA for 2025 could reflect these changes.

Healthcare Costs

As mentioned earlier, rising healthcare costs are a significant concern for retirees. A higher COLA would help offset these costs, making it a critical factor for retirees who rely heavily on Social Security.

Economic Policies

Government policies, including those related to taxation, social welfare, and economic stimulus, can also impact inflation and, consequently, the COLA for 2025.

Planning Ahead: What Retirees Should Do

As we approach the announcement of the Social Security COLA 2025, retirees should;

Stay

Informed

Keep an eye on economic reports and updates from the Social Security Administration (SSA) to stay informed about potential COLA changes.

Review Financial Plans

Work with a financial advisor to review and adjust retirement plans, ensuring that any COLA changes are factored into income strategies.

Budget for Uncertainties

Prepare for potential increases in living costs by adjusting budgets and setting aside extra funds for unexpected expenses.

Conclusion

The Social Security COLA 2025 will play a vital role in determining the financial well-being of millions of American retirees. By understanding how COLA is calculated, why it’s important, and what to expect for 2025, retirees and those approaching retirement can better prepare for the future. With careful planning and attention to these adjustments, it’s possible to maintain financial security and enjoy a comfortable retirement.

For more information and updates on the Social Security COLA 2025, stay tuned to trusted financial news sources and consult with a financial advisor like us, Pension Deductions who understands the nuances of Social Security benefits.

For more information and updates on the Social Security COLA 2025, stay tuned to trusted financial news sources and consult with a financial advisor like us, Pension Deductions who understands the nuances of Social Security benefits.

SHARE THIS POST

Related Blogs

Generation X and Retirement

Read More »

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Shrideep Murthy

April 7, 2025

9:15 pm

Defined Benefit Plan vs 401k: Best Pension Plans for Small Business Owners

Read More »

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Shrideep Murthy

February 25, 2025

2:48 pm

How Small Business Owners Can Save Up to $300,000 in Taxes with a Pension Plan

Read More »

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Shrideep Murthy

February 17, 2025

9:15 pm

The Ultimate Guide to Using a Cash Balance Plan Calculator in 2025

Read More »

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Shrideep Murthy

January 28, 2025

10:05 pm