Roth IRA contribution limits for 2024 are crucial for individuals planning their retirement savings strategy. As financial landscapes evolve, staying informed about these limits is paramount for maximizing your retirement savings potential. In this comprehensive guide, we delve into the intricacies of Roth IRA contribution limits for 2024, empowering you to make informed decisions regarding your financial future.

What Are Roth IRA Contribution Limits?

Roth IRA contribution limits refer to the maximum amount of money you can contribute to your Roth IRA account within a given tax year. These limits are set by the Internal Revenue Service (IRS) and are subject to change annually based on various factors, including inflation and economic conditions.

Roth IRA Contribution Limits for 2024

For the tax year 2024, the Roth IRA contribution limits remain unchanged from the previous year. Individuals under the age of 50 can contribute $6,000 annually to their Roth IRA accounts. Additionally, individuals aged 50 and above have the option of making catch-up contributions, allowing them to contribute an additional $1,000, bringing their total annual contribution limit to $7,000.

Factors Influencing Roth IRA Contributions

Several factors can influence your eligibility to contribute to a Roth IRA and the amount you can contribute. These factors include your filing status, modified adjusted gross income (MAGI), and participation in employer-sponsored retirement plans such as 401(k)s.

Filing Status

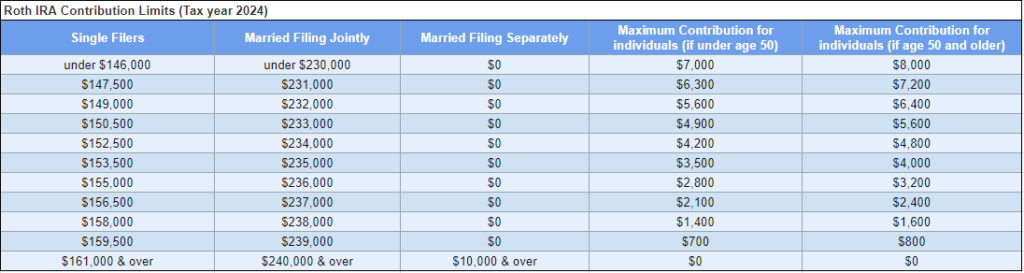

Your filing status plays a significant role in determining your Roth IRA contribution limits. For the tax year 2024, individuals filing as single, head of household, or married filing separately (if you did not live with your spouse during the year) are subject to the following income limitations:

- Single Filers: Full contribution allowed if MAGI is less than $129,000. Contributions phase out between $129,000 and $144,000. No contributions allowed if MAGI exceeds $144,000.

- Married Filing Jointly: Full contribution allowed if MAGI is less than $204,000. Contributions phase out between $204,000 and $214,000. No contributions allowed if MAGI exceeds $214,000.

Modified Adjusted Gross Income (MAGI)

Your MAGI is your adjusted gross income (AGI) with certain deductions added back. It serves as the basis for determining your eligibility for Roth IRA contributions. Calculating your MAGI accurately is crucial in understanding your contribution limits and avoiding potential tax implications.

Employer-Sponsored Retirement Plans

Participation in employer-sponsored retirement plans such as 401(k)s can affect your Roth IRA contributions. High earners who contribute to these plans may face reduced or phased-out Roth IRA contribution limits based on their MAGI.

Want to Know More about Roth IRA Contributions?

Click here to Schedule a Free Consultation Today!Planning Your Roth IRA Contributions

Understanding Roth IRA contribution limits for 2024 is the first step in optimizing your retirement savings strategy. By staying informed about annual contribution limits and eligibility criteria, you can make proactive decisions to maximize your retirement nest egg while minimizing tax implications.

Tips for Maximizing Roth IRA Contributions

- Regularly Review Contribution Limits: Stay updated on annual contribution limits and adjust your contributions accordingly to make the most of your Roth IRA account.

- Utilize Catch-Up Contributions: If you are aged 50 or above, take advantage of catch-up contributions to boost your retirement savings in preparation for your golden years.

- Consider Roth Conversion Strategies: Explore Roth conversion strategies to transfer funds from traditional retirement accounts into Roth IRAs, providing tax diversification and potential long-term savings advantages.

Conclusion

Navigating Roth IRA contribution limits for 2024 requires careful planning and understanding of IRS regulations. By familiarizing yourself with annual limits, eligibility criteria, and strategic planning strategies, you can take proactive steps to secure your financial future and enjoy a comfortable retirement.