Understanding 401k to IRA Rollover Rules

As retirement approaches, many individuals find themselves considering their options for managing their retirement savings. One common strategy is to rollover 401k to IRA accounts. This guide provides comprehensive insights into the benefits, process, and considerations when rolling over your 401k into an IRA.

Understanding the Rollover Process from 401k to IRA

Why Consider a Rollover?

Increased Investment Choices

One significant advantage of rolling over your 401k to an IRA is the expanded investment options. While 401k plans typically offer a limited selection of mutual funds, IRAs provide access to a broader range of investments, including stocks, bonds, ETFs, and even real estate.

Potential for Lower Fees

IRAs often have lower fees than 401k plans, depending on the investment provider. By rolling over 401k to IRA, you may save money on administrative costs and management fees, which can significantly impact your retirement savings over time.

Flexible Withdrawal Options

Unlike 401k plans, which impose strict withdrawal rules, IRAs provide more flexibility regarding withdrawals. This flexibility can be beneficial if you need to access your funds before reaching retirement age.

Types of IRAs for Your Rollover

When considering a rollover 401k to IRA, it’s essential to understand the types of IRAs available:

Traditional IRA

Roth IRA

A Roth IRA operates differently. While you’ll pay taxes on the money you roll over from your 401k, your withdrawals in retirement will be tax-free, provided certain conditions are met. This can be advantageous if you anticipate being in a higher tax bracket during retirement.

Schedule a Free Consultation Now!

The Rollover Process

-

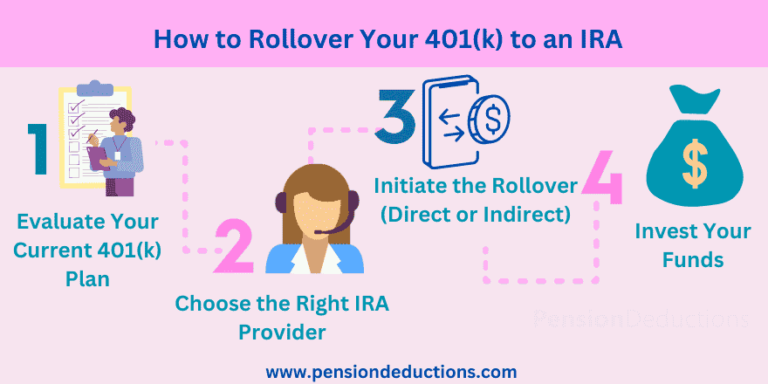

Evaluate Your Current 401k Plan

Step 1

Before initiating the rollover 401k to IRA process, review your current 401k plan to understand its fees, investment options, and any associated penalties for withdrawing your funds.

-

Choose the Right IRA Provider

Step 2

Selecting the right IRA provider is crucial for a successful rollover. Consider factors such as investment options, fees, customer service, and educational resources.

-

Initiate the Rollover

Step 3

You can initiate a rollover in one of two ways:

In a direct rollover, your 401k funds are transferred directly to your chosen IRA provider. This method avoids withholding taxes and penalties, making it the preferred option for most individuals.

An indirect rollover involves receiving a check for your 401k balance, which you must deposit into your IRA within 60 days. Failing to complete the transfer within this timeframe could result in taxes and penalties.

-

Invest Your Funds

Step 4

Once your funds have been transferred, it's time to decide how to invest them. Take the time to review your investment options and develop a diversified portfolio that aligns with your retirement goals.

Key Considerations when Rolling Over your 401k

Tax Implications

Fees and Expenses

Compare the fees associated with your current 401k plan and the new IRA. Higher fees can erode your retirement savings, so it’s essential to find a provider that offers low-cost investment options.

Withdrawal

Rules

Future Contributions

Future Contributions

Withdrawal

Rules

Common Mistakes to Avoid

Failing to Research

Before making any decisions, it’s crucial to research your options thoroughly. Understanding the benefits and drawbacks of rolling over your 401k to an IRA will help you make informed choices.

Ignoring Fees

Overlooking the fees associated with your IRA can lead to unexpected costs in the long run. Always ask for a detailed breakdown of fees before committing to a provider.

Neglecting to Diversify Investments

After rolling over your funds, ensure that you diversify your investments. Concentrating too heavily in one asset class can increase your risk and hinder your retirement growth.

Missing Deadlines

If you opt for an indirect rollover, be vigilant about the 60-day window for depositing your funds into the IRA. Missing this deadline can result in taxes and penalties.

Conclusion

If you’re considering a rollover 401k to IRA, reach out to a financial advisor or retirement planner to ensure you make the best decisions for your specific situation. Taking these steps now can lead to greater financial stability in your retirement years.

SHARE THIS POST

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.

Discover the 3 retirement rule changes in 2025, including contribution limits, RMD updates, and automatic portability. Plan smarter today!

Year-end financial planning in the USA helps optimize retirement savings, reduce taxes, and secure your future with proactive strategies.