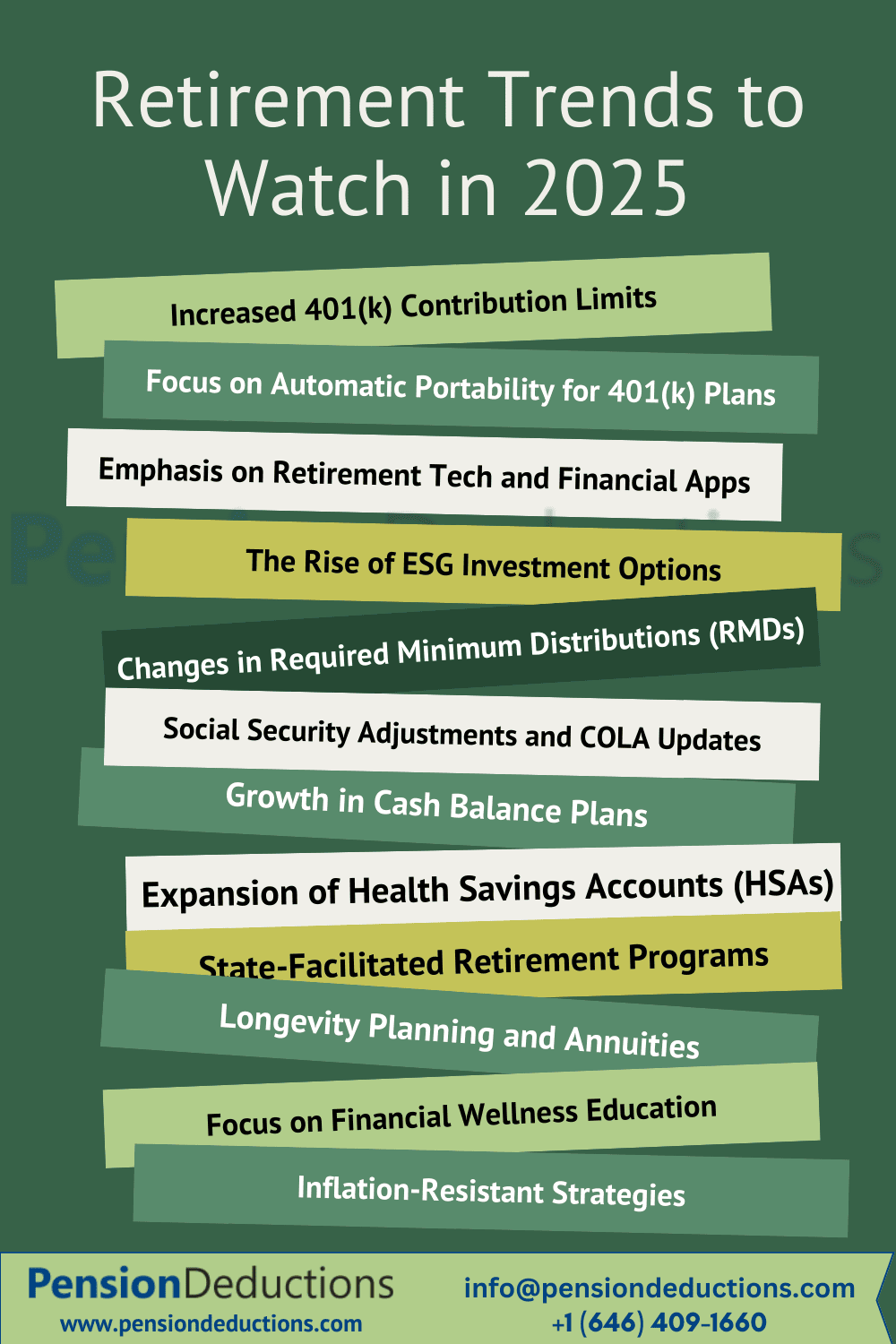

Retirement Trends in 2025

1. Increased Contribution Limits for Retirement Accounts

One of the most significant retirement rule changes in 2025 is the increase in contribution limits for tax-advantaged accounts like 401(k)s and IRAs.

Key Updates

For Retirement Trends in 2025, the maximum contribution limit for 401(k) plans has increased to $23,000, with an additional $7,500 catch-up contribution for individuals over 50.

Impact: This change encourages higher savings rates and provides flexibility for those nearing retirement.

2. Focus on Automatic Portability for 401(k) Plans

Why It Matters?

With job changes becoming more frequent, automatic portability streamlines savings management and prevents unnecessary account fees.

3. Emphasis on Retirement Tech and Financial Apps

Examples of Advancements:

AI-Driven Calculators: Personalized financial advice based on unique circumstances.

Virtual Financial Advisors: Interactive AI bots providing 24/7 guidance on contributions and withdrawals.

Schedule a Free Consultation Now!

4. The Rise of ESG Investment Options

Why It’s Trending?

Socially conscious investing resonates with the growing focus on sustainability and ethical financial practices.

5. Changes in Required Minimum Distributions (RMDs)

2025 Updates

The RMD age has increased to 75, reflecting longer life expectancies and changing financial needs.

Effect: Retirees gain flexibility in managing their taxable income and preserving retirement assets.

6. Social Security Adjustments and COLA Updates

Social Security remains a cornerstone of retirement planning. The 2025 Cost-of-Living Adjustment (COLA) reflects inflation trends, providing increased benefits to retirees.

What to Expect in 2025?

A COLA increase of 3.2%, ensuring retirees maintain purchasing power despite rising living costs.

Improved online tools for Social Security management.

7. Growth in Cash Balance Plans

Why It’s Popular in 2025?

Employers find them cost-effective compared to traditional pensions.

Employees benefit from predictable growth rates and lump-sum payout options.

8. Expansion of Health Savings Accounts (HSAs)

Key Benefits

Tax-free contributions, growth, and withdrawals for medical expenses.

High contribution limits in 2025 make HSAs attractive for long-term savings.

Schedule a Free Consultation Now!

9. State-Facilitated Retirement Programs

2025 Spotlight

Programs like California’s CalSavers and OregonSaves are setting benchmarks for inclusivity in retirement savings.

10. Longevity Planning and Annuities

Why It’s Important?

Retirees seek stability in uncertain economic times, making annuities a reliable option.

11. Focus on Financial Wellness Education

Popular Topics

Understanding contribution limits.

Maximizing employer benefits.

Managing retirement risks.

12. Inflation-Resistant Strategies

Trend Insight

Advisors recommend inflation-adjusted investments to preserve purchasing power.

FAQs

Conclusion

SHARE THIS POST

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!