Retirement Security Rule: What it is?

What is the Retirement Security Rule?

Background and Development

Key Components of the Retirement Security Rule

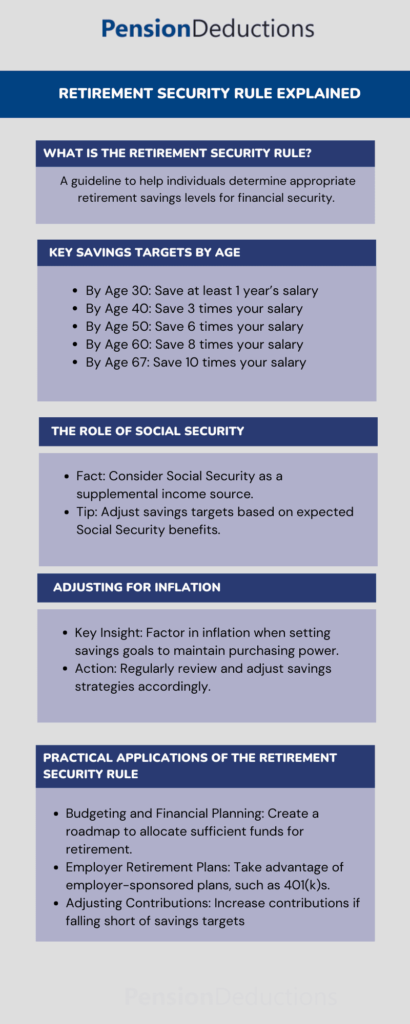

Savings Targets

-

By Age 30

Aim to have saved at least one year’s salary.

-

By Age 40

Aim to have saved three times your annual salary.

-

By Age 50

Aim to have saved six times your annual salary.

-

By Age 60

Aim to have saved eight times your annual salary.

-

By Age 67

Aim to have saved ten times your annual salary.

Adjusting for Inflation

The Role of Social Security

Practical Applications of the Retirement Security Rule

Budgeting and Financial Planning

Employer Retirement Plans

Adjusting Contributions

Schedule a Free Consultation Now!

Challenges in Implementing the Retirement Security Rule

Economic Uncertainty

Debt Management

Financial Literacy

The Importance of Professional Guidance

Customizing Retirement Plans

Staying Informed

Conclusion

Embracing the principles of the Retirement Security Rule empowers individuals to take control of their financial destinies, ensuring they are well-prepared for a comfortable and secure retirement. Whether you are just starting your career or approaching retirement age, understanding and implementing the Retirement Security Rule can significantly impact your financial well-being. Start today by assessing your savings progress and making the necessary adjustments to achieve your retirement goals.

SHARE THIS POST

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!