Retirement Savings Tips for 55 to 64 Year

In this article, we will discuss six important retirement savings tips to help you boost your savings and maximize your retirement funds. These tips are especially useful if you’re still working and have time to adjust your retirement strategy. Let’s dive into how you can make the most of your financial situation and prepare for a smooth transition into retirement.

Key Takeaways

-

If you're between 55 and 64, it's not too late to significantly improve your retirement savings.

-

One of the best retirement savings tips is to maximize your 401(k) or other retirement plan contributions if you haven't already done so.

-

You may also want to reconsider working a little longer to increase your pension or Social Security benefits.

Top 6 Retirement Savings Tips

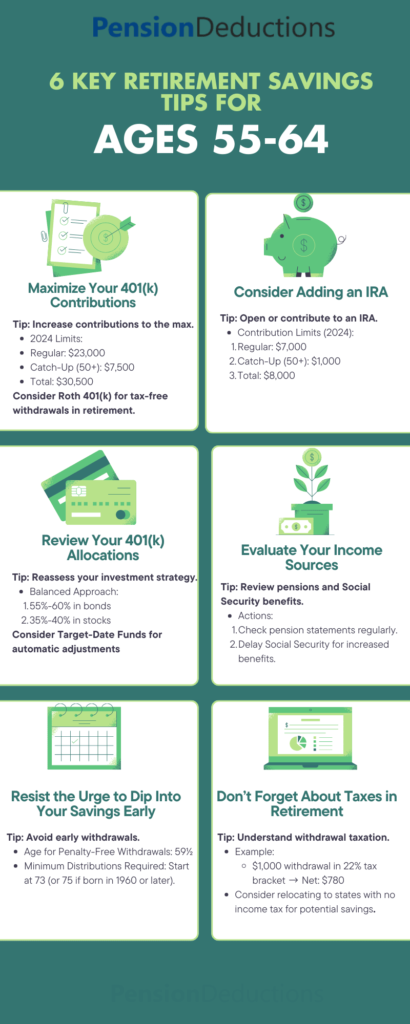

1. Maximize Your 401(k) Contributions

For those in their 50s or early 60s, this is especially important because these are often your peak earning years. That means you may be in a higher tax bracket now than you will be in retirement, allowing you to reduce your tax burden in the future.

In 2024, the maximum contribution limit for a 401(k) is $23,000. However, if you’re over 50, you’re eligible for an additional catch-up contribution of $7,500, bringing the total to $30,500. Contributing the maximum amount is one of the best retirement savings tips you can follow to boost your nest egg quickly.

If your employer offers a Roth 401(k) option, consider it as well. While Roth contributions are taxed upfront, your withdrawals in retirement will be tax-free, providing a unique tax advantage.

2. Review Your 401(k) Allocations

However, being too conservative could stunt the growth of your portfolio. A balanced approach is typically the best strategy. For instance, you might consider a portfolio that holds 55% to 60% in bonds and 35% to 40% in stocks. Diversifying your investments is a key retirement savings tips to help you maintain growth while managing risk.

If you haven’t revisited your asset allocation since your earlier years, now’s the time to do so. Many employers also offer target-date funds, which automatically adjust their asset mix based on your expected retirement date. These funds can provide a hands-off approach to portfolio management but often come with higher fees, so it’s essential to review your options carefully.

3. Consider Adding an IRA

There are two main types of IRAs: traditional and Roth. Traditional IRAs allow you to make pre-tax contributions, reducing your taxable income for the year. However, you’ll pay taxes when you withdraw the funds in retirement. Roth IRAs, on the other hand, require you to pay taxes upfront, but withdrawals are tax-free as long as the account has been open for at least five years.

Understanding which IRA is right for you is a critical retirement savings tips. If you expect to be in a higher tax bracket in retirement, a Roth IRA might be the better option. If not, a traditional IRA could offer more immediate tax benefits.

Schedule a Free Consultation Now!

4. Evaluate Your Income Sources

If you have a pension, it’s essential to review your benefits statement, which you should receive at least every three years. This statement will show how much you’ve earned in benefits and when they become vested. In some cases, it may be worth working a little longer to increase your pension benefits, especially if they are calculated based on salary and years of service.

Social Security is another vital component of retirement income for most Americans. You can begin claiming Social Security benefits as early as age 62, but doing so will result in permanently reduced payments. Waiting until your full retirement age (67 for those born after 1960) or even delaying until age 70 can increase your monthly benefit substantially. Deciding when to claim Social Security is a crucial retirement savings tips that can have a significant impact on your financial well-being.

5. Resist the Urge to Dip Into Your Retirement Savings Early

While there are some exceptions—such as the IRS’s Rule of 55, which allows penalty-free withdrawals for those who leave their jobs after age 55—it’s generally advisable to let your retirement accounts continue to grow. Keep in mind that once you turn 73 (or 75 if born in 1960 or later), you’ll be required to start taking minimum distributions from your traditional retirement accounts.

Understanding these rules is key to ensuring that you don’t outlive your savings, making it a vital retirement savings tips for anyone nearing retirement.

6. Don’t Forget About Taxes in Retirement

You may also want to consider the tax benefits of relocating to a state with no income tax or a lower tax rate. This can help you keep more of your retirement savings.

Common Retirement Mistakes to Avoid

Conclusion

The last decade before retirement is crucial. With a solid plan in place and these retirement savings tips in mind, you can confidently step into the next phase of your life, knowing you’ve done everything possible to secure your financial future.

SHARE THIS POST

Millions of retirees will see increased Social Security Benefits in April 2025 due to WEP and GPO eliminations—learn how it impacts you!

Discover the 3 retirement rule changes in 2025, including contribution limits, RMD updates, and automatic portability. Plan smarter today!

Year-end financial planning in the USA helps optimize retirement savings, reduce taxes, and secure your future with proactive strategies.

Uncover how Social Security Reforms 2024 will impact retirees with crucial changes to taxes, benefits, and retirement age adjustments.