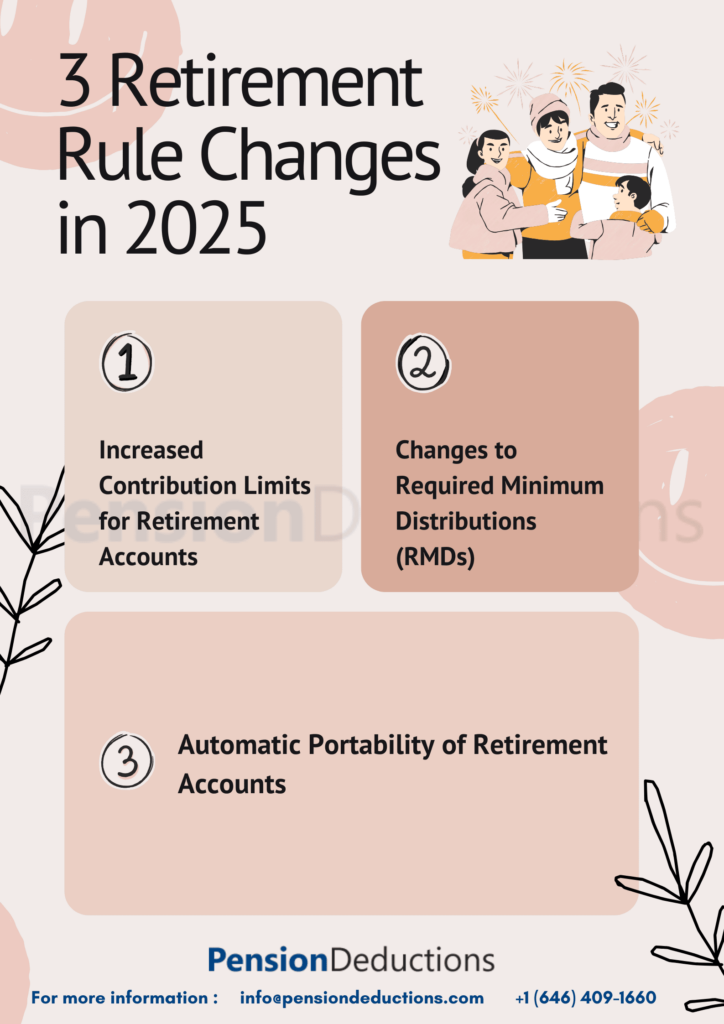

Retirement Savings Contributions in 2025

The Importance of Staying Updated

Key Changes to Retirement Savings Contributions in 2025

1. Increased Contribution Limits

Why This Matters?

2. Super Catch-Up Contributions for Ages 60–63

How to Leverage This?

3. Health Savings Account (HSA) Enhancements

Strategies for Maximizing Retirement Savings Contributions in 2025

-

Prioritize Employer Matches

Many employers offer matching contributions to 401(k) plans. Ensure you're contributing at least enough to receive the full match, as this is essentially free money that boosts your retirement savings.

-

Automate Contributions

Automation helps you stay consistent and avoid missing opportunities to maximize your Retirement Savings Contributions in 2025. Set up automatic deductions from your pay check to fund your 401(k), IRA, or HSA accounts.

-

Re-evaluate Your Budget

With increased contribution limits, it may be time to reassess your budget. Identify areas where you can cut discretionary spending and redirect those funds into your retirement accounts.

-

Utilize Tax Refunds and Bonuses

Consider directing a portion of tax refunds or year-end bonuses into your retirement accounts. This strategy not only boosts your savings but also reduces taxable income.

Contact Us Today!

The Impact of Inflation and Market Trends

Understanding the Role of Inflation

Navigating Market Volatility

The Role of Employers in Retirement Planning

Enhanced Retirement Tools

Education and Financial Literacy

Common Challenges and Solutions

Limited

Cash Flow

Solution:

Start small and increase contributions gradually over time. Even small increments can significantly impact long-term savings when compounded over years.

Competing

Financial Goals

Solution:

Work with a financial advisor to create a holistic plan that aligns with your goals while prioritizing Retirement Savings Contributions in 2025.

The Future of Retirement Savings Contributions

Legislative

Outlook

Shifting Demographics

Conclusion

As retirement planning continues to evolve, staying proactive and adaptable will ensure your golden years are financially secure and fulfilling. Start planning today and unlock the power of Retirement Savings Contributions in 2025!

SHARE THIS POST

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!