Retirement Plans for Small Business Owners

As a small business owner, you probably wear a lot of hats. From managing employees to overseeing operations, it can feel like there’s no time left for anything else. But one thing you shouldn’t put off is planning for your future. Unlike employees at large corporations, you don’t have a company-funded retirement plan waiting for you. That’s why setting up Retirement Plans for Small Business Owners is crucial to ensure you have financial security when you decide to hang up the keys to your business.

In this guide, we’ll walk you through the top Retirement Plans for Small Business Owners in the US, how they work, and how to choose the right one for your needs. Let’s dive in!

In this guide, we’ll walk you through the top Retirement Plans for Small Business Owners in the US, how they work, and how to choose the right one for your needs. Let’s dive in!

Why Retirement Plans for Small Business Owners Matter

Running a small business is unpredictable. You never know what the future might bring, and without a solid retirement plan, your financial security could be at risk. Retirement Plans for Small Business Owners aren’t just about setting money aside—they offer tax advantages, can help retain employees, and ultimately provide peace of mind.

When you set up a retirement plan, you’re not just investing in your future; you’re also ensuring that your business will have the resources to continue thriving, even after you’re no longer running it day-to-day.

When you set up a retirement plan, you’re not just investing in your future; you’re also ensuring that your business will have the resources to continue thriving, even after you’re no longer running it day-to-day.

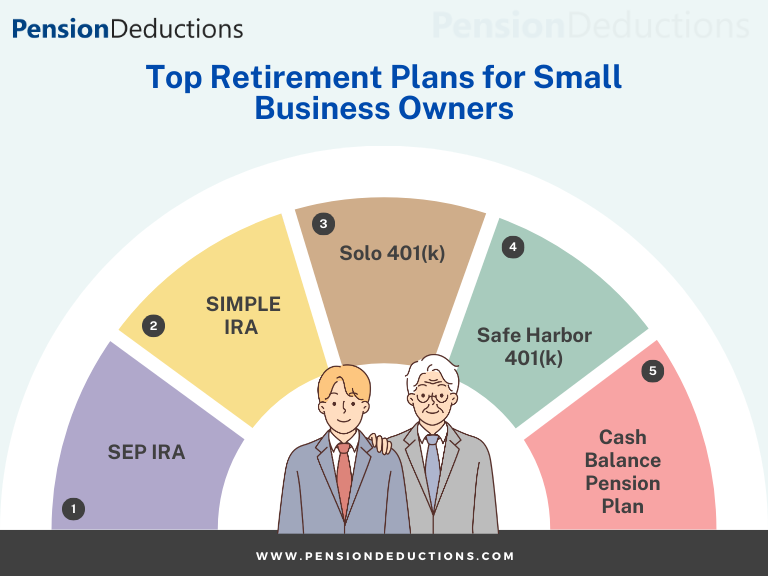

Top Retirement Plans for Small Business Owners

Here’s a breakdown of the top Retirement Plans for Small Business Owners to help you make an informed decision.

Which Retirement Plan is Right for You?

So, which of these Retirement Plans for Small Business Owners is best for you? It depends on your business structure, the number of employees you have, and how much you want to contribute each year. Here’s a quick guide to help you decide:

- If you're a solo entrepreneur, the Solo 401(k) or SEP IRA might be your best bet.

- For those with a small team, consider a SIMPLE IRA or Safe Harbor 401(k).

- If you're looking to contribute as much as possible, a Cash Balance Pension Plan could be the right choice.

To help you understand more in detail about which Retirement Planning Strategies small business owners is apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

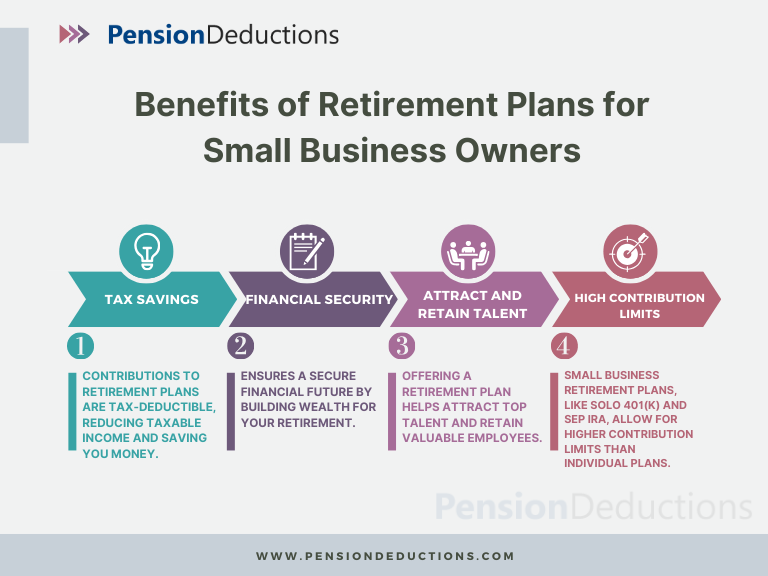

Benefits of Retirement Plans for Small Business Owners

Establishing Retirement Plans for Small Business Owners comes with a variety of benefits:

- Tax Advantages: Contributions to retirement plans are typically tax-deductible, helping you save money now while planning for your future.

- Attracting and Retaining Talent: Offering a retirement plan as part of your benefits package can help you attract top talent and encourage loyalty among your employees.

- Financial Security: Most importantly, retirement plans give you peace of mind knowing that your financial future is secure, regardless of how your business performs in the long term.

Conclusion

Setting up Retirement Plans for Small Business Owners is essential for ensuring both your personal financial future and the long-term success of your business. Whether you’re looking for something simple like a SEP IRA or a more robust plan like a Cash Balance Pension Plan , Pension Deductions is here to guide you through the process.

To help you understand more in detail about which Retirement Planning Strategies for small business owners is apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

Take the first step towards a secure future today—reach out to Pension Deductions and explore your options for Retirement Plans for Small Business Owners.

To help you understand more in detail about which Retirement Planning Strategies for small business owners is apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

Take the first step towards a secure future today—reach out to Pension Deductions and explore your options for Retirement Plans for Small Business Owners.

SHARE THIS POST

Related Blogs

The Best Retirement Plans for Small Business Owners in the US

Read More »

Retirement Plans for Small Business Owners As a small business owner, you probably wear a lot of hats. From managing employees to overseeing operations, it

Shrideep Murthy

September 11, 2024

7:58 pm

Top Retirement Planning Strategies for Small Business Owners

Read More »

Top Retirement Planning Strategies for Small Business Owners Planning for retirement can feel like a daunting task, especially when you’re running a small business. As

Shrideep Murthy

September 5, 2024

9:59 pm

The Rising Popularity of Cash Balance Plans among Small & Mid-Sized Businesses

Read More »

Cash Balance Plans for Small & Mid-Sized Businesses As the landscape of retirement planning continues to evolve, small to mid-sized businesses are increasingly turning to

Shrideep Murthy

August 20, 2024

3:02 pm

The Ultimate Guide to Small Business Pension Plans

Read More »

Introduction In today’s competitive business landscape, offering a robust pension plan is essential for small businesses aiming to attract and retain top talent. A well-structured

Shrideep Murthy

July 16, 2024

10:54 am