Top Retirement Planning Strategies for Small Business Owners

Planning for retirement can feel like a daunting task, especially when you’re running a small business. As a small business owner, your focus is often split between growing your business and ensuring its financial stability. But what about your financial future? When it’s time to step away from the day-to-day grind, will you be ready?

Let’s dive into some practical, actionable retirement planning strategies tailored specifically for small business owners. These strategies will help you secure your financial future while continuing to build and manage your business.

Let’s dive into some practical, actionable retirement planning strategies tailored specifically for small business owners. These strategies will help you secure your financial future while continuing to build and manage your business.

Understanding the Importance of Retirement Planning Strategies

Why Retirement Planning Strategies is Crucial for Small Business Owners

Running a small business is more than a full-time job; it’s your livelihood. But what happens when it’s time to retire? Unlike traditional employees, small business owners often don’t have a company-sponsored 401(k) or pension plan. It’s up to you to ensure that your retirement is as prosperous as your career and hence retirement planning strategies for small business owners is utmost important.

The Risk of Delaying Retirement Planning Strategies for Small Business Owners

Putting off retirement planning can be tempting, especially when there are more immediate concerns, like payroll, taxes, or expanding your business. However, the longer you wait, the fewer options you’ll have to maximize your savings. Early and proactive planning allows you to take advantage of compound interest, tax benefits, and diversified investments. To help you understand more in details about which Retirement Planning Strategies small business owners is apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

Setting Retirement Goals

Defining Your Retirement Vision through Retirement Planning Strategies for Small Business Owners

Before diving into the financials, take a step back and consider what you want your retirement to look like. Do you plan to travel? Spend more time with family? Maybe you want to start a new venture or finally write that book. Defining your retirement vision in a comprehensive Retirement Planning Strategies for small business owners will guide your financial planning decisions.

Calculating Your Retirement Needs through the right Retirement Planning Strategies for Small Business Owners

Once you have a vision, the next step is figuring out how much money you’ll need to make it a reality. Consider factors such as your desired lifestyle, healthcare costs, inflation, and potential long-term care needs. There are numerous retirement calculators like the one available at Pension Deductions through the Defined Benefit Calculator, which can help you estimate your contribution amount you’ll need and with the help of Pension Deductions Consultants you will find your perfect Retirement Planning Strategies for Small Business Owners.

Factoring in the Future in Retirement Planning Strategies for Small Business Owners

Will your business continue to generate income after you retire? Do you plan to sell it, pass it on to a family member, or close it down? The future of your business will play a significant role in your retirement planning strategies. For instance, if you plan to sell, you’ll need to factor the sale proceeds into your retirement plan.

Choosing the Right Retirement Plan

Exploring Retirement Plan Options

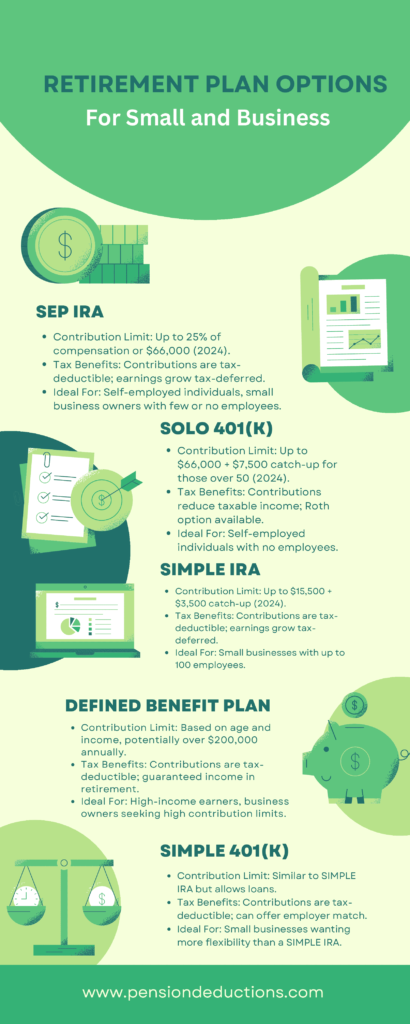

Small business owners have several retirement plan options, each with its own benefits and considerations. A Retirement Planning Consultant like Pension Deductions can help you in choosing the best Retirement Planning Strategies for Small Business Owners. Here’s a breakdown of the most popular choices:

Simplified Employee Pension (SEP) IRA

SEP IRAs are a popular choice for small business owners due to their simplicity and high contribution limits . You can contribute up to 25% of your net earnings from self-employment, with a maximum limit of $66,000 (for 2024). SEP IRAs are easy to set up and have minimal administrative costs.

Solo 401(k) Plans

If you’re self-employed with no employees (other than your spouse), a Solo 401(k). is an excellent option. It offers high contribution limits—up to $66,000 in 2024, plus an additional $7,500 if you’re over 50. Additionally, Solo 401(k)s allow for both employee and employer contributions, giving you more flexibility.

Simple IRA

The SIMPLE IRA is ideal for businesses with up to 100 employees. It’s easy to administer and allows both employer and employee contributions. While the contribution limits are lower than a SEP or Solo 401(k), it’s a solid option for businesses looking to provide a retirement plan for their employees.

Defined Benefit Plans

For business owners with higher incomes, a Defined Benefit Plan may be worth considering. This plan allows for much higher contribution limits based on your age and income, potentially up to hundreds of thousands of dollars annually. However, it comes with more administrative complexity and costs.

Comparing the Tax Benefits

Each retirement plan offers different tax advantages. For example, contributions to SEP IRAs and Solo 401(k)s are tax-deductible, reducing your taxable income. With a Defined Benefit Plan, contributions are tax-deductible, and earnings grow tax-deferred until withdrawal. Understanding these benefits can help you maximize your retirement savings.

Diversifying Your Investments

The Importance of Diversification

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” This principle is crucial in retirement planning. Diversifying your investments helps manage risk and provides a more stable return over time.

Balancing Risk and Reward

As a small business owner, your business is likely your most significant investment. While it’s essential to focus on growing your business, it’s equally important to diversify your retirement portfolio across different asset classes—stocks, bonds, real estate, and other investments. This approach balances the potential for high returns with the need for security as you approach retirement.

Exploring Alternative Investments

Alternative investments, such as real estate, precious metals, or private equity, can add another layer of diversification to your retirement portfolio. These investments often have different risk and return profiles compared to traditional stocks and bonds, providing additional opportunities for growth and protection against market volatility.

Planning for Healthcare Costs

Estimating Healthcare Expenses

Healthcare is one of the most significant expenses in retirement. As you age, medical costs can skyrocket, making it crucial to plan for these expenses. Consider long-term care insurance, Health Savings Accounts (HSAs), and Medicare options as part of your retirement strategy.

Using Health Savings Accounts (HSAs)

If you have a high-deductible health plan, an HSA is a tax-advantaged way to save for healthcare costs in retirement. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. Plus, after age 65, you can use HSA funds for non-medical expenses without penalties, though they will be taxed as income.

Considering Social Security

Maximizing Social Security Benefits

Social Security can be a valuable source of income in retirement, but knowing when to start taking benefits is key. While you can begin claiming benefits at age 62, waiting until full retirement age (usually 66 or 67) will increase your monthly benefit. Delaying benefits until age 70 maximizes your payout.

Coordinating Social Security with Your Retirement Plan

Social Security should be one piece of your overall retirement plan. Consider how your Social Security benefits will interact with your other retirement income sources. For instance, if you continue working after claiming Social Security, your benefits may be reduced if you haven’t reached full retirement age.

Planning for the Unexpected

Building an Emergency Fund

Life is unpredictable, and having a financial cushion is essential. An emergency fund can cover unexpected expenses, such as medical emergencies, business downturns, or economic recessions, without derailing your retirement plan. Aim to save 3-6 months of living expenses in a liquid, easily accessible account.

Considering Life and Disability Insurance

Life and disability insurance can provide financial security for you and your family in the event of illness, injury, or death. These policies can help replace lost income, cover medical expenses, and ensure your business continues to operate smoothly.

Creating an Exit Strategy for Your Business

Planning for Business Succession

Your business is likely one of your most valuable assets, and planning for its future is critical. Whether you intend to sell the business, pass it on to a family member, or close it down, having a well-thought-out exit strategy is essential for a smooth transition.

Valuing Your Business

Before selling or transferring your business, you’ll need to determine its value. A professional business valuation provides an accurate assessment, helping you set a fair sale price or determine the value for estate planning purposes.

Selling Your Business

If you plan to sell, start the process well before your retirement date. This allows time to find the right buyer and negotiate a deal that reflects your business’s true value. Consider working with a business broker or financial advisor to guide you through the process.

Seeking Professional Guidance

The Role of Financial Advisors in Retirement Planning Strategies

Retirement planning can be complex, and seeking professional advice is often a wise move. A

financial advisor

specializing in retirement planning can help you navigate the intricacies of your options, optimize your tax strategy, and ensure you’re on track to meet your goals.

Working with a CPA

A Certified Public Accountant (CPA) can help you understand the tax implications of your retirement plan, maximize deductions, and ensure you’re in compliance with all regulations. Their expertise is invaluable, particularly when retirement planning strategies for small business owners with complex financial situations.

Staying Flexible

Adapting Your Plan Over Time

Life changes, and so should your retirement plan. Regularly review and update your retirement planning strategies for small businesses owners to reflect changes in your business, personal life, and financial situation. Flexibility is key to ensuring that your retirement plan remains relevant and effective.

Preparing for Economic Uncertainty

The economy can be unpredictable, and market downturns can affect your retirement savings. By staying informed and working with your financial advisor, you can adjust your investment strategy to protect your retirement funds and take advantage of growth opportunities.

Conclusion

Retirement planning strategies for small business owners may seem overwhelming, but with the right strategies in place, you can secure a comfortable and fulfilling retirement. Start by defining your retirement goals, choosing the right retirement plan, and diversifying your investments. Don’t forget to consider healthcare costs, Social Security, and potential risks along the way. And, of course, seek professional consultation from advisors like us, Pension Deductions when needed. With careful planning and a proactive approach, you’ll be well on your way to enjoying a stress free retirement with the perfect Retirement Planning Strategies for Small Business Owners.

SHARE THIS POST

Related Blogs

Generation X and Retirement

Read More »

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Shrideep Murthy

April 7, 2025

9:15 pm

Fidelity Investment in the USA

Read More »

Discover why Fidelity Investment remains a top choice in 2024, offering low costs, advanced tools, and innovative solutions for every investor.

Shrideep Murthy

November 19, 2024

9:15 pm

Understanding the Social Security Administration for Retirement in USA 2024

Read More »

Learn how the Social Security Administration impacts retirement in 2024, including benefit calculations, eligibility, and strategies for maximizing your Social Security income.

Shrideep Murthy

November 13, 2024

9:15 pm

Retirement in USA

Read More »

Planning for retirement in USA involves Social Security, inflation strategies, and choosing the best states, ensuring a secure financial future.

Shrideep Murthy

November 6, 2024

9:15 pm