Retirement Expectations 2025

Understanding Retirement Expectations

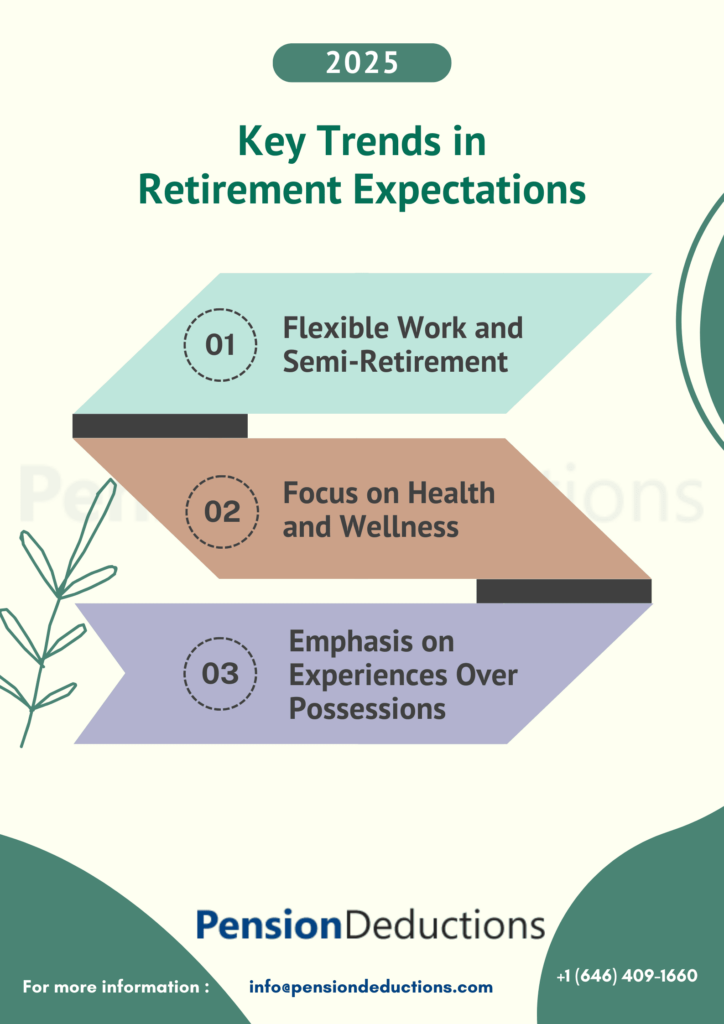

Key Trends in Retirement Expectations 2025

-

Flexible Work and Semi-Retirement

Many retirees no longer view retirement as a full stop to their careers. Instead, they anticipate engaging in freelance work, consulting, or part-time employment to maintain income and a sense of purpose.

-

Focus on Health and Wellness

With advancements in healthcare, more retirees expect to invest in wellness activities like yoga, fitness classes, and healthy eating. The aim is to extend their active years and reduce healthcare costs.

-

Emphasis on Experiences Over Possessions

A growing trend among retirees is prioritizing experiences—travel, learning, and connecting with loved ones—over material possessions. These aspirations often require careful financial planning.

Financial Security: The Foundation of Retirement Aspirations

Steps to Meet Financial Retirement Expectations

-

Create a Detailed Budget

Estimating post-retirement expenses is essential. Include costs for housing, healthcare, leisure, and unexpected emergencies.

-

Optimize Retirement Savings

Contribute to retirement accounts such as 401(k) plans, IRAs, or cash balance plans. Take advantage of employer-matching contributions to maximize savings.

-

Plan for Longevity

Given increasing life expectancies, retirees should prepare for a retirement spanning 20-30 years or more. Diversifying investments and considering annuities can help provide a steady income.

Take Action Today to Secure Your Future!

Retirement Expectations 2025 Across Generations

Baby Boomers

Generation X

Millennials and Gen Z

Overcoming Challenges to Meet Retirement Expectations 2025

Rising Healthcare Costs

Market Volatility

Underestimating Longevity

Aspiring for a Fulfilling Retirement Lifestyle

-

Hobbies and Learning Opportunities

Many retirees use their newfound time to pursue hobbies or acquire new skills. This could include painting, gardening, learning a language, or taking up photography.

-

Social Connections

Strong social bonds contribute significantly to happiness in retirement. Retirees often prioritize spending time with family, reconnecting with friends, and participating in community activities.

-

Travel and Exploration

Exploring new destinations is a common aspiration. Whether it’s international travel or road trips closer to home, retirees value experiences that create lasting memories.

FAQs

Conclusion

Whether you’re planning decades in advance or adjusting your current strategy, aligning your goals with the realities of modern retirement can set you on the path to success.

SHARE THIS POST

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!