Retirement Annuities

When planning for retirement, one of the key components that often comes into play is retirement annuities. These financial products can provide a steady stream of income in your golden years, but like any investment, they come with their own set of advantages and disadvantages. This blog aims to shed light on the latest information surrounding retirement annuities, helping you make informed decisions about your retirement planning.

What are Retirement Annuities?

Types of Retirement Annuities

Immediate Annuities

Immediate retirement annuities begin making payments to the annuitant right away, usually after a single lump-sum payment is made. They are ideal for individuals looking to convert a portion of their retirement savings into a predictable income stream.

Deferred Annuities

Deferred retirement annuities accumulate funds over time and provide payments at a later date. They can be beneficial for individuals who want to save for retirement and then convert those savings into an income stream when they retire.

Fixed Annuities

Fixed retirement annuities provide a guaranteed payout amount and a fixed interest rate for the accumulation phase. They offer predictability and stability, making them a safer investment option.

Variable Annuities

Payments from variable retirement annuities can vary based on the performance of underlying investments. While they offer the potential for higher returns, they also come with more risk.

Understanding the Features of Retirement Annuities

Tax Deferral

The money you invest in a retirement annuity grows tax-deferred until you start making withdrawals, allowing your investment to grow without immediate tax implications.

Death Benefits:

Riders

Schedule a Free Consultation Now!

Pros of Retirement Annuities

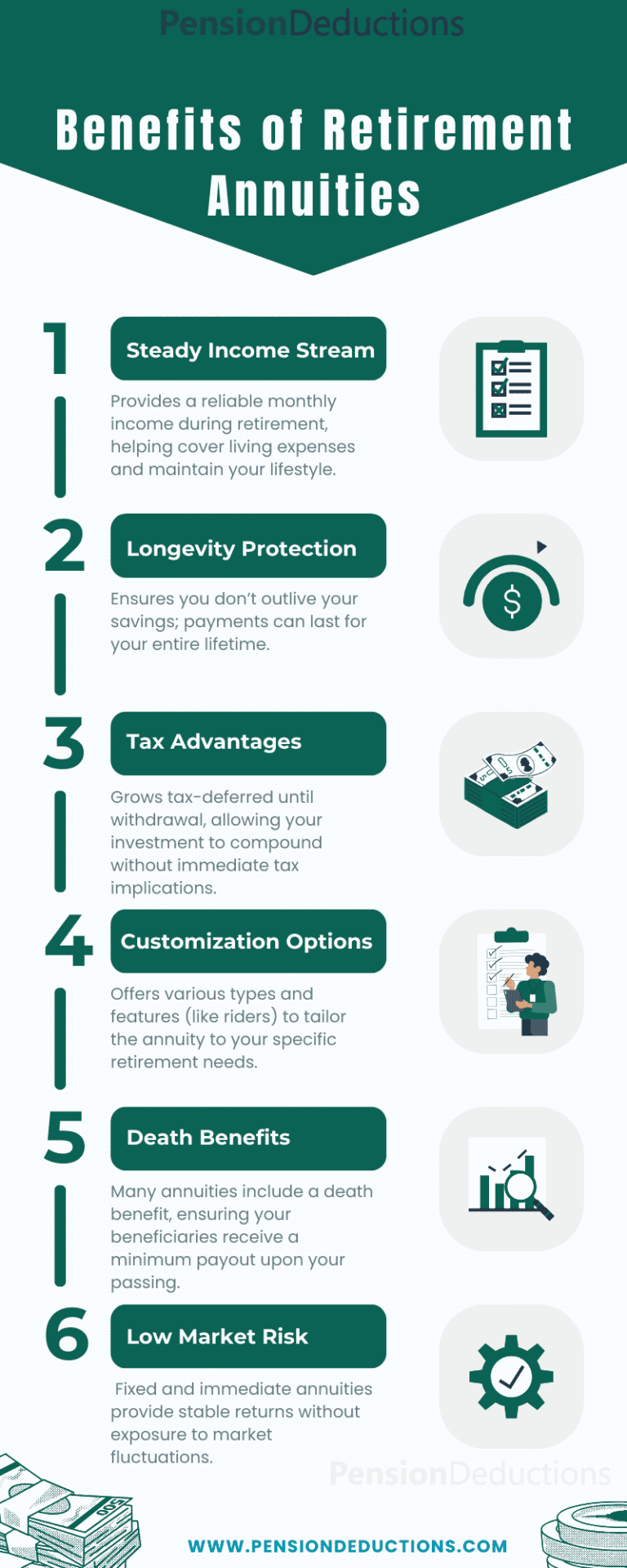

Steady Income Stream

One of the most significant advantages of retirement annuities is their ability to provide a reliable income stream during retirement. This can help retirees cover essential living expenses without worrying about market volatility.

Longevity Protection

Retirement annuities can provide payments for the lifetime of the annuitant, which means you won’t outlive your savings. This is especially important given increasing life expectancies.

Tax Advantages

The tax-deferral feature allows your investment in retirement annuities to grow without being taxed until you begin withdrawals, making them an attractive option for long-term savings.

Customization Options

With various types of retirement annuities and the ability to add riders, individuals can customize their annuities to suit their specific retirement needs.

Cons of Retirement Annuities

Complexity

Retirement annuities can be complex financial instruments, and understanding their terms, features, and benefits may require a significant investment of time and effort. Misunderstanding the details can lead to poor financial decisions.

Fees and Expenses

Many retirement annuities come with high fees and expenses, including surrender charges for early withdrawals, which can diminish the overall return on investment.

Limited Access to Funds

Once you invest in a retirement annuity, accessing your funds can be difficult. Many annuities impose penalties for early withdrawals, limiting your liquidity.

Inflation Risk

While some retirement annuities offer inflation protection, many do not. This can lead to a decrease in purchasing power over time, especially in periods of high inflation.

How to choose the Right Retirement Annuity

When considering retirement annuities, it’s essential to evaluate your financial situation and retirement goals. Here are some key factors to consider:

Assess your Income Needs

Evaluate the Fees

Consult a Financial Advisor

Understand the Terms

Consult a Financial Advisor

Conclusion

Retirement annuities can be a valuable tool in your retirement planning strategy, offering a steady income stream and various tax advantages. However, they also come with complexities, fees, and limitations that require careful consideration. By understanding the pros and cons of retirement annuities and evaluating your individual needs, you can make an informed decision about whether a retirement annuity is the right choice for you.

As you approach retirement, take the time to explore all your options, consult with financial professionals, and ensure that your retirement plan is tailored to your unique circumstances.

SHARE THIS POST

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.