Pension Plans for Small Business Owners

In this guide, we’ll explore how defined benefit plans, cash balance plans, and 401(k) options can help small business owners significantly lower their tax liability.

1. Why Pension Plans are a Game-Changer for Small Business Owners?

Key Benefits of Pension Plans

-

Tax Deductions

Contributions to qualified pension plans are tax-deductible.

-

Tax-Deferred Growth

Your investments grow tax-free until withdrawal.

-

Retirement Security

Unlike IRAs and traditional 401(k)s, advanced pension plans allow larger contributions.

-

Lower Payroll Taxes

Employer contributions reduce taxable payroll expenses.

According to IRS guidelines, high-income small business owners can shield up to $300,000 annually from taxation with the right pension plan.

2. Best Pension Plans for Small Business Owners to Reduce Taxes

-

Defined Benefit Pension Plans (Best for High-Income Business Owners)

A.

How it saves taxes:

-

Contributions are 100% tax-deductible, reducing your taxable income significantly.

-

Assets grow tax-deferred, meaning no capital gains tax until withdrawal

-

Ideal for business owners over 40 who want to maximize contributions before retirement

Best for Solo entrepreneurs, doctors, attorneys, consultants, and high-revenue businesses.

-

Cash Balance Pension Plans (Best for Partnerships & Small Companies with Employees)

B.

How it saves Taxes.

Best for Business owners who have a few employees and want a tax-friendly retirement plan.

-

Contributions up to $300,000+ per year are tax-deductible.

-

Reduces the adjusted gross income (AGI) , lowering tax liability.

-

Employers can contribute both to themselves and employees while keeping business expenses deductible.

-

Safe Harbor 401(k) with Profit Sharing (Best for Small Business Owners Wanting Flexibility)

C.

How it saves Taxes.

Best for Small businesses looking for a low-maintenance and highly flexible retirement plan.

-

Employer match contributions are tax-deductible.

-

Reduces personal and corporate tax liability.

-

Profit-sharing feature allows additional contributions for owners.

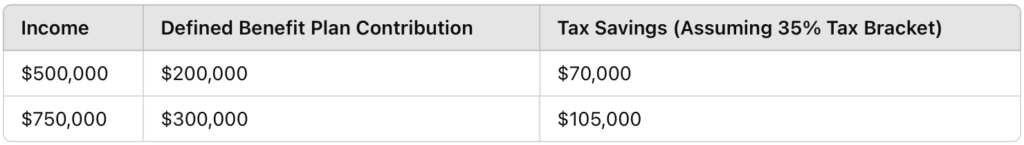

3. Real-World Tax Savings Case Study

- Income: $800,000/year

- Business Type: Solo medical practice (S-Corp)

- Tax Bracket: 37% Federal + 6% State = 43% Total Tax

- Total taxable income: $800,000

- Taxes owed (43% of income): $344,000

- New taxable income: $500,000

- Taxes owed: $215,000

- Total tax savings: $129,000!

4. How to Set Up a Pension Plan & Start Saving

Step 1: Choose the Right Plan

- Solo entrepreneurs: Defined Benefit Plan

- Small businesses with employees: Cash Balance Plan

- Flexible savings: Safe Harbor 401(k)

Step 2: Work with a Pension Plan Consultant

- Get a customized tax savings analysis based on your income.

- Work with an IRS-certified actuary to design a high-contribution plan.

Step 3: Maximize Contributions Before Tax Deadlines

- S-Corps & LLCs: Set up before December 31st

- Contributions can be made before filing corporate taxes (March 15 or September 15 extension)

Use our free Pension Plan Calculator and

Schedule a Consultation today!

Model Title

“A defined benefit plan requires the assumption of a retirement age which is normally 62 or 65. Since you have already reached this age we will need to perform further actuarial adjustments in order to calculate your defined benefit contribution. Unfortunately, this cannot be done online. Please get in touch with our office and we will come up with a projection for you. You can reach us at info@pensiondeductions.com or get in touch with us here.”

Let’s TalkFAQ's about Pension Plans for Small Business Owners

Conclusion: Start Saving Big on Taxes Today!

📢 Next Steps:

✅ Use our Pension Plan Calculator to estimate your tax savings.

✅ Schedule a free consultation with our pension experts.

✅ Start saving BIG on taxes before the next IRS deadline!

🚀 Ready to take action? Get Your Free Pension Plan Consultation Now!

SHARE THIS POST

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.