Individual Retirement Account (IRA)

What is an Individual Retirement Account (IRA)?

Importance of IRAs in Retirement Planning

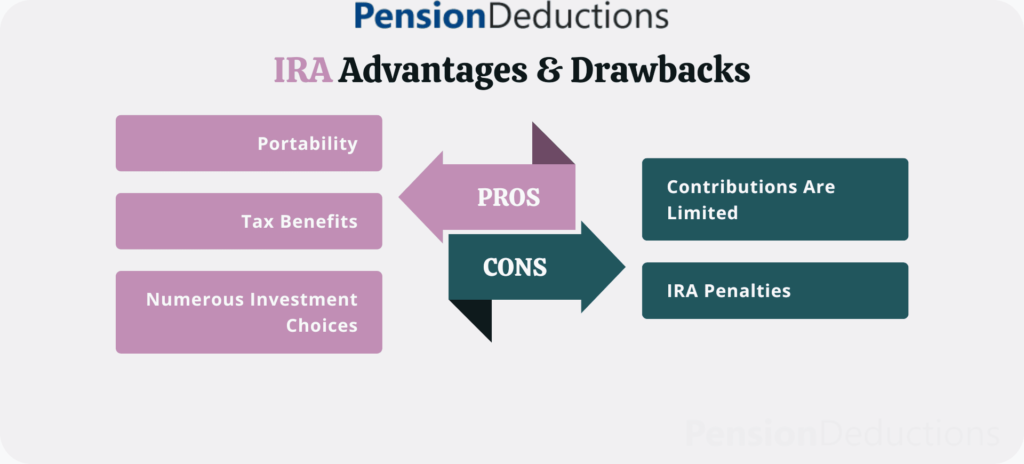

Benefits of Using an IRA

Tax Advantages

Depending on the type of IRA, you can enjoy tax deductions on contributions or tax-free withdrawals in retirement.

Flexible Investment Options

IRAs typically offer a wide range of investment choices, including stocks, bonds, ETFs, and mutual funds.

Retirement Security

IRAs provide a structured way to save for retirement, helping you build a financial cushion for your future.

Schedule a Free Consultation Now!

4 Types of Individual Retirement Accounts

Traditional IRA

A Traditional IRA is one of the most common types of Individual Retirement Accounts. Contributions to a Traditional IRA may be tax-deductible, depending on your income and whether you or your spouse are covered by a retirement plan at work.

Key Features:

Tax-Deductible Contributions: For 2024, individuals can contribute up to $6,500 ($7,500 if age 50 or older). These contributions may reduce your taxable income for the year.

Tax-Deferred Growth: Investments within the account grow tax-deferred until you begin making withdrawals during retirement.

Withdrawal Rules: Withdrawals before age 59½ may incur a 10% penalty, and you’ll owe income tax on the amount withdrawn.

Roth IRA

The Roth IRA is another popular choice among retirement savers and is distinct from the Traditional IRA due to its tax structure. Understanding the types of Individual Retirement Accounts helps in making informed decisions about contributions.

Key Features:

After-Tax Contributions: Contributions are made with after-tax dollars, meaning you pay taxes on the money before contributing.

Tax-Free Withdrawals: Qualifying withdrawals during retirement are tax-free, which can be a significant advantage if you expect to be in a higher tax bracket later in life.

Contribution Limits: Similar to Traditional IRAs, the contribution limit for 2024 is $6,500 ($7,500 for those aged 50 and older), but income limits apply (phasing out at $138,000 for single filers).

SEP IRA

A Simplified Employee Pension (SEP) IRA is tailored for self-employed individuals and small business owners. This type of IRA allows for higher contribution limits, making it an attractive option for those with fluctuating income. Knowing the types of Individual Retirement Accounts available can guide business owners in retirement planning.

Key Features:

Higher Contribution Limits: For 2024, you can contribute up to 25% of your income or $66,000, whichever is lower.

Employer Contributions: Business owners can make contributions on behalf of employees, making it a great option for small businesses looking to provide retirement benefits.

Easy Administration: SEP IRAs have fewer administrative requirements than other retirement plans, making them easier to manage for small businesses.

SIMPLE IRA

The Savings Incentive Match Plan for Employees (SIMPLE) IRA is another option for small businesses, particularly those with fewer than 100 employees. This plan allows both employee and employer contributions, showcasing the variety within the types of Individual Retirement Accounts.

Key Features:

Contribution Limits: Employees can contribute up to $15,500 in 2024, with an additional catch-up contribution of $3,500 for those aged 50 and older.

Employer Contributions Required: Employers must either match employee contributions up to 3% of their salary or make a fixed contribution of 2% of each eligible employee’s compensation.

Easier to Set Up: Compared to other retirement plans, SIMPLE IRAs are relatively easy to establish and maintain.

Conclusion

Before making a decision, it’s essential to consider your current financial situation, tax implications, and long-term retirement goals. Consulting with a financial advisor can help ensure you choose the right type of IRA for your needs. Start investing in your future today by exploring the various types of Individual Retirement Accounts and finding the best fit for your retirement plan.

SHARE THIS POST

Discover the 3 retirement rule changes in 2025, including contribution limits, RMD updates, and automatic portability. Plan smarter today!

Year-end financial planning in the USA helps optimize retirement savings, reduce taxes, and secure your future with proactive strategies.

Learn how the Social Security Administration impacts retirement in 2024, including benefit calculations, eligibility, and strategies for maximizing your Social Security income.

Planning for retirement in USA involves Social Security, inflation strategies, and choosing the best states, ensuring a secure financial future.