Cash Balance vs. Traditional Pension Plans: Which is Better for Your Retirement?

What are Traditional Pension Plans?

Key Features of Traditional Pension Plans:

What Are Cash Balance Pension Plans?

Key Features of Cash Balance Pension Plans:

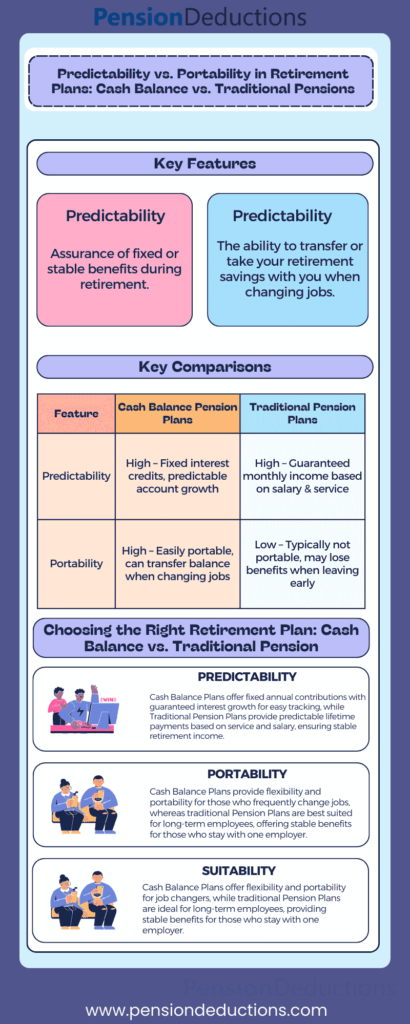

Predictability and Portability: Critical Factors in 2024

Predictability

Traditional Pension

Plans

Cash Balance Pension Plans

Portability

Traditional Pension

Plans

Cash Balance Pension Plans

Advantages of Cash Balance Pension Plans in 2024

-

Higher Contribution Limits for high-income earners, Cash Balance Pension Plans allow larger contributions than traditional 401(k)s. This makes them an attractive option for maximizing retirement savings in 2024.

-

Tax Benefits: Contributions to cash balance plans are tax-deferred, offering significant tax savings for both employees and employers. In the debate of Cash Balance vs. Traditional Pension Plans, the tax advantages of cash balance plans make them especially appealing to small business owners and high-income earners.

-

Portability for a Mobile Workforce: Given the increasing job mobility in the U.S., the portability of Cash Balance Pension Plans is a crucial factor. Unlike traditional pensions, employees can retain and transfer their retirement savings if they switch jobs.

-

Appeal to Employers: Employers are increasingly adopting cash balance plans because they can attract and retain top talent by offering both predictability and portability to employees.

Advantages of Traditional Pension Plans in 2024

-

Guaranteed Income for Life: One of the main advantages of traditional pension plans is the guaranteed monthly payment for life, which provides a high degree of financial security. In comparing Cash Balance vs. Traditional Pension Plans, those seeking the stability of lifelong payments may prefer traditional pensions.

-

Employer Responsibility: Traditional pensions are fully employer-funded, meaning employees bear no investment risk. This hands-off approach appeals to those who prefer not to manage their retirement savings actively.

-

Ideal for Long-Term Employees: Traditional pensions work best for employees who stay with a single employer for many years, as vesting and benefit formulas often favor long-term service.

Making the Right Choice: Cash Balance vs. Traditional Pension Plans in 2024

On the other hand, if you prioritize lifelong guaranteed income and prefer a more hands-off approach, traditional pension plans might be a better fit.

Conclusion: The Future of Retirement Planning in 2024

To determine which plan is right for you, consult with a retirement advisor. At Pension Deductions, we specialize in helping clients navigate the complexities of retirement planning. Contact us today for a free consultation and personalized advice on Cash Balance vs. Traditional Pension Plans.

SHARE THIS POST

Maximizing Your Tax Savings with Cash Balance Pension Plans When it comes to planning for retirement, maximizing tax savings is a smart move. One of

Intoduction In the realm of retirement savings strategies, Market Based Cash Balance Plans have emerged as a beacon of innovation, reshaping traditional paradigms and offering

Understanding the for Cash Balance Plans contribution limits in 2024 is crucial for both employers and employees aiming to maximize retirement benefits and optimize tax

Understanding the Cash Balance Plan In today’s dynamic economic landscape, individuals are constantly seeking financial strategies that offer stability, growth, and security. Amidst various retirement