Automatic Portability of 401k: Revolutionizing Retirement Savings in 2025

The automatic portability of 401k is a game-changer that ensures a seamless transfer of retirement funds from one employer’s plan to another, without manual intervention. This initiative, introduced under the SECURE 2.0 Act, aims to streamline the retirement savings process and safeguard workers’ financial futures.

Understanding Automatic Portability

This reform is particularly beneficial for younger employees and those in industries with high turnover rates, such as retail, hospitality, and gig economy jobs. These workers often have small retirement balances that, when left behind, are subject to fees or forgotten entirely. By enabling automatic portability, retirement savings remain intact and continue to grow over time, regardless of job changes.

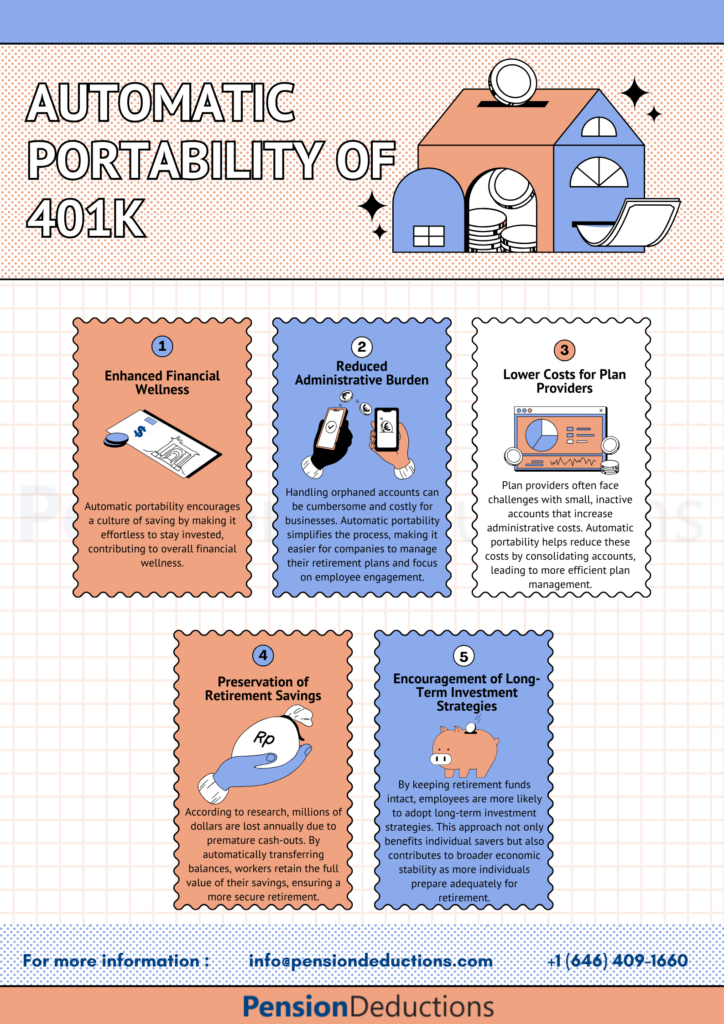

Key Benefits of Automatic Portability of 401k

Preservation of Retirement Savings

One of the biggest advantages of automatic portability of 401k is the preservation of retirement funds. According to research, millions of dollars are lost annually due to premature cash-outs. By automatically transferring balances, workers retain the full value of their savings, ensuring a more secure retirement.

Reduced Administrative Burden

Employers also benefit from reduced administrative responsibilities. Handling orphaned accounts can be cumbersome and costly for businesses. Automatic portability simplifies the process, making it easier for companies to manage their retirement plans and focus on employee engagement.

Enhanced Financial Wellness

Employees who retain their savings across multiple jobs are more likely to achieve their long-term financial goals. Automatic portability encourages a culture of saving by making it effortless to stay invested, contributing to overall financial wellness.

Lower Costs for Plan Providers

Plan providers often face challenges with small, inactive accounts that increase administrative costs. Automatic portability helps reduce these costs by consolidating accounts, leading to more efficient plan management.

Encouragement of Long-Term Investment Strategies

By keeping retirement funds intact, employees are more likely to adopt long-term investment strategies. This approach not only benefits individual savers but also contributes to broader economic stability as more individuals prepare adequately for retirement.

The Role of Technology in Automatic Portability

Blockchain technology, in particular, is being explored for its potential to enhance security and transparency in the rollover process. By using decentralized ledgers, the risk of data breaches is minimized, and employees can track their account transfers in real-time.

Impact on Employee Retention and Engagement

Schedule a Free Consultation Now!

Challenges and Considerations

Employers and plan administrators must work together to address these challenges, offering transparent communication and robust cybersecurity measures. By doing so, they can build trust and encourage broader adoption of this revolutionary retirement savings feature.

A Look Ahead: The Future of Retirement Savings

Employers, employees, and plan providers must adapt to these changes and embrace the opportunities they present. By doing so, they can create a retirement ecosystem that not only preserves savings but also empowers workers to take control of their financial futures.

In conclusion, automatic portability of 401k is more than just a procedural change—it’s a fundamental shift in how Americans approach retirement savings. With its potential to reduce leakage, enhance financial wellness, and simplify plan management, this reform is poised to redefine retirement planning for generations to come.

SHARE THIS POST

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.

Discover the 3 retirement rule changes in 2025, including contribution limits, RMD updates, and automatic portability. Plan smarter today!

Year-end financial planning in the USA helps optimize retirement savings, reduce taxes, and secure your future with proactive strategies.