401(k) vs. SEP IRA for Small Businesses

As a small business owner, selecting the right retirement plan for yourself and your employees is a critical step toward securing financial stability in the future. Two of the most popular retirement plan options for small businesses in the United States are the 401(k) and SEP IRA. Both plans offer significant tax advantages, but they differ in terms of contributions, flexibility, and administrative complexity. In this article, we will explore the key differences between the 401(k) vs. SEP IRA for small businesses, helping you make an informed decision about which plan best suits your business needs.

What is a 401(k)?

A 401(k) plan is one of the most widely recognized retirement savings options in the United States, designed primarily for employees in larger organizations. However, small businesses can also benefit from offering a 401(k) plan. A 401(k) allows employees to save for retirement by contributing a portion of their pre-tax income to a retirement account. Employers can also choose to match a portion of their employees’ contributions, making it an attractive option for businesses looking to offer competitive benefits.

One of the primary benefits of a 401(k) for small businesses is its flexibility. Employers can choose whether or not to offer matching contributions, and employees can decide how much they want to contribute based on their personal financial situation. Additionally, there are tax advantages for both employees and employers, as contributions are tax-deferred until withdrawn at retirement.

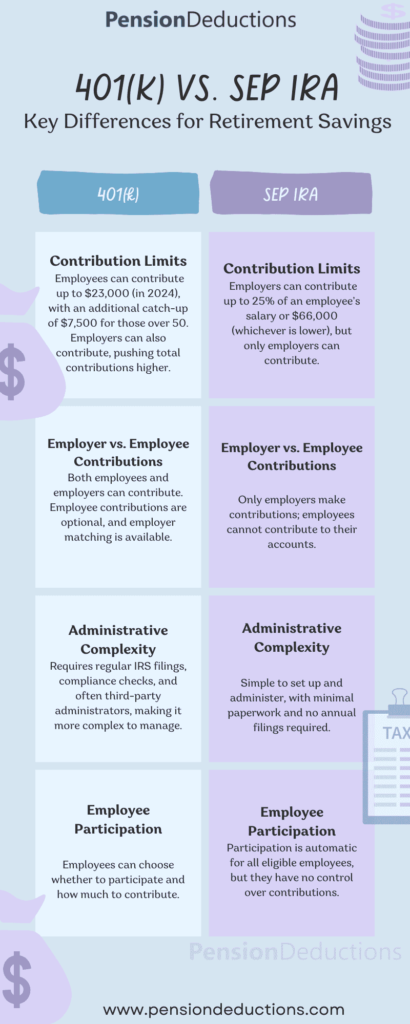

For small businesses, a 401(k) vs. SEP IRA for small businesses comparison typically hinges on factors like contribution limits and administrative complexity. The maximum employee contribution to a 401(k) in 2024 is $23,000, with an additional $7,500 allowed as a catch-up contribution for employees aged 50 and older.

One of the primary benefits of a 401(k) for small businesses is its flexibility. Employers can choose whether or not to offer matching contributions, and employees can decide how much they want to contribute based on their personal financial situation. Additionally, there are tax advantages for both employees and employers, as contributions are tax-deferred until withdrawn at retirement.

For small businesses, a 401(k) vs. SEP IRA for small businesses comparison typically hinges on factors like contribution limits and administrative complexity. The maximum employee contribution to a 401(k) in 2024 is $23,000, with an additional $7,500 allowed as a catch-up contribution for employees aged 50 and older.

What is a SEP IRA?

A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a retirement plan designed specifically for small business owners and self-employed individuals. Like a 401(k), a SEP IRA allows employers to make tax-deductible contributions to their employees’ retirement savings. However, the SEP IRA is generally easier to set up and administer, making it a more streamlined option for small business owners with limited time and resources.

One of the primary advantages of a SEP IRA is the higher contribution limit. In 2024, small business owners can contribute up to 25% of an employee’s salary or up to $66,000, whichever is lower. This makes the SEP IRA an ideal choice for businesses with fluctuating income, as the contribution amount can be adjusted annually depending on the company’s profitability.

Another important aspect of the 401(k) vs. SEP IRA for small businesses discussion is the level of employer involvement. With a SEP IRA, only the employer can make contributions, and employees do not have the option to contribute to the account themselves. This simplifies the process but may be less appealing to employees who want to take an active role in their retirement savings.

One of the primary advantages of a SEP IRA is the higher contribution limit. In 2024, small business owners can contribute up to 25% of an employee’s salary or up to $66,000, whichever is lower. This makes the SEP IRA an ideal choice for businesses with fluctuating income, as the contribution amount can be adjusted annually depending on the company’s profitability.

Another important aspect of the 401(k) vs. SEP IRA for small businesses discussion is the level of employer involvement. With a SEP IRA, only the employer can make contributions, and employees do not have the option to contribute to the account themselves. This simplifies the process but may be less appealing to employees who want to take an active role in their retirement savings.

Key Differences Between 401(k) vs. SEP IRA for Small Businesses

When comparing a 401(k) vs. SEP IRA for small businesses, there are several critical differences to consider. One of the most notable differences is the contribution limit. As mentioned earlier, the maximum employee contribution for a 401(k) is $23,000 (for those under 50) in 2024, with employer contributions able to push the total savings up significantly. In contrast, a SEP IRA allows up to 25% of an employee’s salary, capped at $66,000.

Another key factor is the administrative complexity of each plan. A 401(k) plan can be more challenging to administer, requiring regular filings with the IRS, ongoing compliance checks, and potential costs associated with hiring third-party administrators. In contrast, a SEP IRA is easy to set up and manage, with minimal paperwork and no annual filing requirements.

The 401(k) vs. SEP IRA for small businesses debate also comes down to the level of flexibility each plan offers. A 401(k) allows for both employee and employer contributions, while a SEP IRA only allows employer contributions. If you want your employees to have the ability to contribute to their own retirement savings, a 401(k) may be a better option. Additionally, a 401(k) may include features like Roth contributions and loans, giving employees more control over how they manage their funds.

Lastly, the issue of employee participation is crucial. In a 401(k), employees can choose to opt into the plan and control how much they contribute. In contrast, SEP IRA participation is automatic for all eligible employees, but they cannot add their own funds to the account.

Another key factor is the administrative complexity of each plan. A 401(k) plan can be more challenging to administer, requiring regular filings with the IRS, ongoing compliance checks, and potential costs associated with hiring third-party administrators. In contrast, a SEP IRA is easy to set up and manage, with minimal paperwork and no annual filing requirements.

The 401(k) vs. SEP IRA for small businesses debate also comes down to the level of flexibility each plan offers. A 401(k) allows for both employee and employer contributions, while a SEP IRA only allows employer contributions. If you want your employees to have the ability to contribute to their own retirement savings, a 401(k) may be a better option. Additionally, a 401(k) may include features like Roth contributions and loans, giving employees more control over how they manage their funds.

Lastly, the issue of employee participation is crucial. In a 401(k), employees can choose to opt into the plan and control how much they contribute. In contrast, SEP IRA participation is automatic for all eligible employees, but they cannot add their own funds to the account.

Which is Right for Your Business?

Choosing between a 401(k) vs. SEP IRA for small businesses depends on several factors, including the size of your business, the number of employees, and how involved you want to be in managing the plan. For small businesses with fewer employees and limited administrative resources, a SEP IRA may be the better choice due to its simplicity and higher contribution limits. However, for businesses with more employees and the desire to offer a robust retirement plan with employee participation, a 401(k) might be the right fit.

It’s important to weigh these options carefully and consider the long-term growth of your business. Consulting with a financial advisor can help you make the best decision based on your specific circumstances.

To help you understand more in detail about which Retirement Planning Strategies small business owners is apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

It’s important to weigh these options carefully and consider the long-term growth of your business. Consulting with a financial advisor can help you make the best decision based on your specific circumstances.

To help you understand more in detail about which Retirement Planning Strategies small business owners is apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

Conclusion

Both the 401(k) and SEP IRA have distinct advantages for small businesses, and the right choice depends on your business’s unique needs. A 401(k) offers flexibility and employee participation, while a SEP IRA provides simplicity and higher employer contribution limits.

To help you understand more in details about which Retirement Planning Strategies for small business owners are apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

To help you understand more in details about which Retirement Planning Strategies for small business owners are apt for you, connect with Pension Deductions advisors for a free consultation to help you better.

SHARE THIS POST

Related Blogs

Generation X and Retirement

Read More »

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Shrideep Murthy

April 7, 2025

9:15 pm

Defined Benefit Plan vs 401k: Best Pension Plans for Small Business Owners

Read More »

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Shrideep Murthy

February 25, 2025

2:48 pm

How Small Business Owners Can Save Up to $300,000 in Taxes with a Pension Plan

Read More »

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Shrideep Murthy

February 17, 2025

9:15 pm

The Ultimate Guide to Using a Cash Balance Plan Calculator in 2025

Read More »

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Shrideep Murthy

January 28, 2025

10:05 pm