Introduction to 401(K) Contribution Limits for 2024

Navigating the intricacies of retirement planning can be daunting, especially when it comes to 401k contribution limits. For individuals over 50, maximizing retirement savings becomes even more crucial. In this comprehensive guide, we’ll delve into the 401k contribution limits for 2024 for those over 50 and offer insights to help you make informed decisions for your retirement.

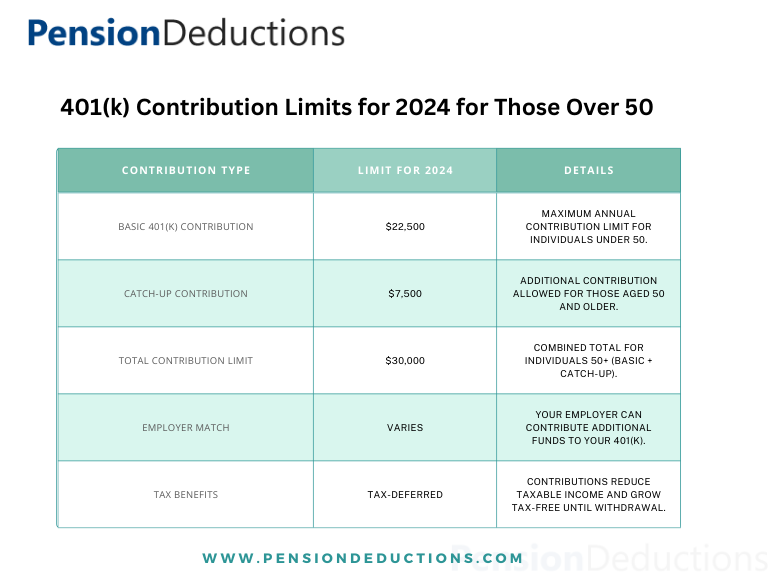

Standard 401k Contribution Limits for 2024

For 2024, the standard 401k contribution limit remains at $20,500 for individuals under 50. This includes both employee and employer contributions. However, for those over 50, there’s an additional catch-up contribution allowed by the IRS.

Maximizing Your Contributions

To make the most out of these contribution limits, it’s essential to have a clear strategy in place. Here are some tips to help you maximize your 401k contributions:

- Start Early: The power of compound interest is undeniable. The earlier you start contributing to your 401k, the more you can benefit from compounding returns.

- Take Advantage of Employer Matching: If your employer offers a 401k match, make sure to contribute at least enough to take full advantage of this benefit. It’s essentially free money that can significantly boost your retirement savings.

- Review Your Budget: Analyze your monthly expenses and identify areas where you can cut back to increase your 401k contributions. Even small increases in contributions can make a significant difference over time.

- Consult a Financial Advisor: A financial advisor can help you develop a personalized retirement savings plan tailored to your goals and financial situation.

Tax Benefits of 401k Contributions

One of the significant advantages of contributing to a 401k is the tax benefits it offers. Contributions to a traditional 401k are made on a pre-tax basis, reducing your taxable income for the year. This can result in immediate tax savings and allow your investments to grow tax-deferred until withdrawal during retirement.

Roth 401k Option

Some employers offer a Roth 401k option, which allows you to make after-tax contributions. While Roth 401k contributions don’t offer immediate tax savings, withdrawals in retirement are tax-free, providing tax diversification in retirement income.

Want to Know More about 401K Plans?

Click here to Schedule a Free Consultation Today!Planning for Required Minimum Distributions (RMDs)

It’s important to note that starting at age 72, individuals are required to take Required Minimum Distributions (RMDs) from their retirement accounts, including 401k plans. Failure to take RMDs can result in hefty penalties. Therefore, it’s crucial to factor in RMDs when planning your retirement withdrawals.

Conclusion

Understanding and maximizing 401k contribution limits for 2024 for those over 50 is essential for building a secure retirement. By taking advantage of catch-up contributions, tax benefits, and employer matches, you can significantly boost your retirement savings. Remember to consult a financial advisor to develop a personalized retirement savings plan that aligns with your goals and financial situation.

SHARE THIS POST

Related Blogs

Increase in Social Security Benefits, April 2025

Read More »

Millions of retirees will see increased Social Security Benefits in April 2025 due to WEP and GPO eliminations—learn how it impacts you!

Shrideep Murthy

April 1, 2025

9:15 pm

Defined Benefit Plan vs 401k: Best Pension Plans for Small Business Owners

Read More »

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Shrideep Murthy

February 25, 2025

2:48 pm

How Small Business Owners Can Save Up to $300,000 in Taxes with a Pension Plan

Read More »

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Shrideep Murthy

February 17, 2025

9:15 pm

Retirement Trends to Watch in 2025

Read More »

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.

Shrideep Murthy

January 2, 2025

9:15 pm