Cash Balance Plan Calculator 2025

Retirement planning has become more complex yet rewarding in 2025, especially with the rise of advanced retirement savings tools like the cash balance plan calculator. This essential tool is helping individuals, small business owners, and professionals optimize their contributions, achieve tax efficiency, and secure their financial future.

As a type of defined benefit plan, cash balance plans allow high-income earners to save significantly for retirement while enjoying unparalleled tax benefits. However, understanding and managing these plans requires careful calculation—something that a cash balance plan calculator can simplify with precision.

This guide provides a deep dive into cash balance plans, the benefits of using a calculator, and actionable steps to leverage these tools effectively in 2025.

What is a Cash Balance Plan?

A cash balance plan is a hybrid retirement plan combining features of traditional pensions and 401(k)s. Each participant has an individual account that grows annually through employer contributions and a guaranteed interest credit.

Key characteristics of Cash Balance Plans include;

-

Higher Contribution Limits

In 2025, cash balance plans allow contributions that far exceed those of 401(k)s, especially for participants over 50.

-

Tax-Deferred Growth

Contributions and interest credits grow tax-free until withdrawal, creating significant tax savings.

-

Predictable Retirement Income

Unlike market-driven plans, cash balance plans offer consistent growth based on pre-determined rates.

Why are Cash Balance Plans Popular in 2025?

With the IRS increasing contribution limits and more professionals seeking ways to minimize taxes, cash balance plans have become a preferred option. Unlike traditional 401(k)s, these plans are customizable, making them ideal for small business owners and high-income professionals who want to maximize their retirement savings.

Whether you’re nearing retirement or just starting your financial journey, understanding cash balance plans—and using a cash balance plan calculator—is essential for planning effectively.

Benefits of Using a Cash Balance Plan Calculator

-

Accurate Projections

The calculator provides precise estimates of your future retirement savings, taking into account factors like your income, age, and desired retirement date. This eliminates guesswork, enabling you to make informed decisions.

-

Maximized Contributions

In 2025, IRS rules allow higher contribution limits for cash balance plans, especially for those aged 50 or older. A calculator ensures that you contribute the maximum allowable amount without exceeding limits, avoiding penalties.

-

Tax Optimization

One of the most significant advantages of cash balance plans is the potential for substantial tax savings. By using a cash balance plan calculator, you can project how contributions will reduce your taxable income, potentially saving thousands of dollars annually.

-

Scenario Comparison

Calculators allow you to test different scenarios, such as adjusting your retirement age or contribution levels. This flexibility helps you identify the best path to achieving your retirement goals.

-

Time-Saving Convenience

Manually calculating contributions, interest credits, and tax implications can be time-consuming and error-prone. A calculator simplifies this process, delivering results in seconds while ensuring accuracy.

For a Free Consultation Today!

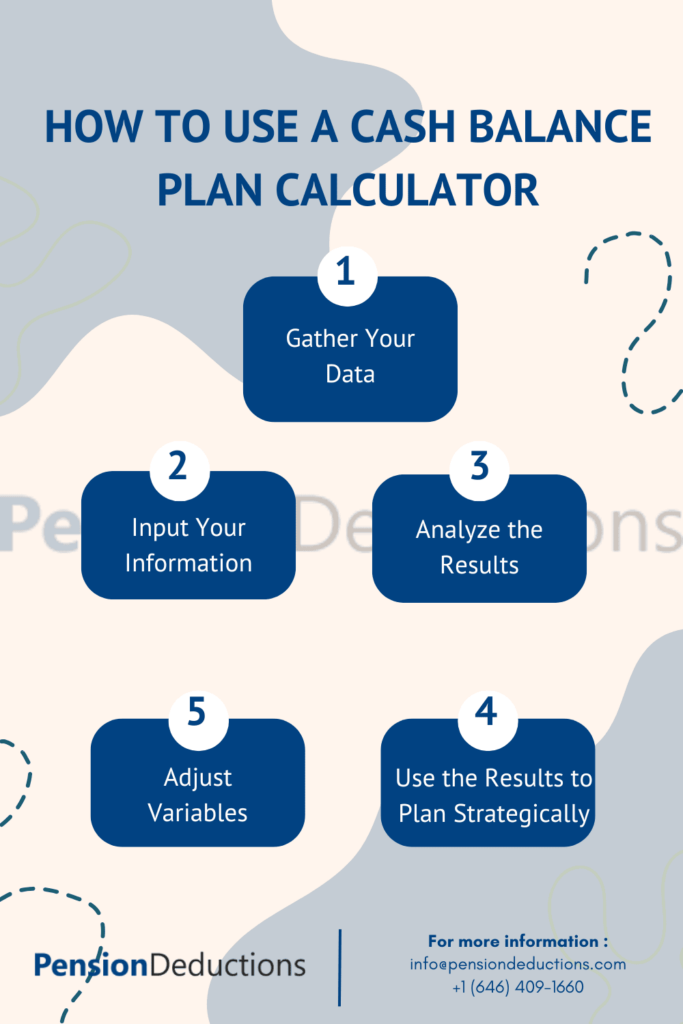

How to Use a Cash Balance Plan Calculator

-

Gather Your Data

1

- Annual income

- Current age and planned retirement age

- Estimated annual interest rate or investment return

- Current savings, if any

-

Input Your Information

2

-

Analyze the Results

3

- Maximum contribution limits for 2025

- Estimated retirement account balance at different ages

- Projected tax savings based on your contributions

-

Adjust Variables

4

-

Use the Results to Plan Strategically

5

Real-Life Examples of Success in 2025

Example 1:

Sarah - The Small Business Owner

Example 2:

Mark - The High-Income Professional

Example 3:

Scenario Testing for a Couple

Choosing the Right Cash Balance Plan Calculator

-

Up-to-Date Features

Ensure the calculator incorporates the latest IRS rules and tax regulations.

-

Ease of Use

A user-friendly interface makes the process simple and efficient.

-

Customization Options

Look for calculators that allow for personalized inputs and scenario testing.

-

Credibility

Use tools from reputable financial institutions or retirement planning services

FAQs

1. Gather essential information, such as your annual income, current age, and retirement goals.

2. Input this data into the calculator to receive precise projections.

3. Review the results to identify your maximum contributions and potential tax savings.

4. Work with Pension Deductions’ advisors to align these results with your broader retirement strategy.

• Small business owners looking to reduce taxable income while providing employee benefits.

• High-income professionals who want to maximize retirement contributions and tax savings.

• Individuals planning for retirement who need precise calculations to achieve their financial goals.

• Your annual income

• Current age and desired retirement age

• Estimated annual investment return or interest credit rate

• Any existing retirement savings

• Higher Contribution Limits: In 2025, cash balance plans allow far greater contributions, particularly for participants over 50.

• Tax-Deferred Growth: Contributions grow tax-free, reducing your taxable income immediately.

• Predictable Growth: Unlike market-driven 401(k)s, cash balance plans provide guaranteed interest credits.

Pension Deductions can help you determine if a cash balance plan is the right fit for your retirement strategy.

• Maximize their contributions

• Take advantage of significant tax deductions

• Align their financial strategy with their retirement goals

Our team stays up-to-date with IRS regulations and ensures you get the most out of your retirement savings.

Conclusion

Whether you’re a high-income professional, a small business owner, or someone planning for early retirement, the right calculator can help you take control of your financial future. Don’t leave your retirement to chance—start using a reliable cash balance plan calculator today and secure a comfortable, stress-free retirement.