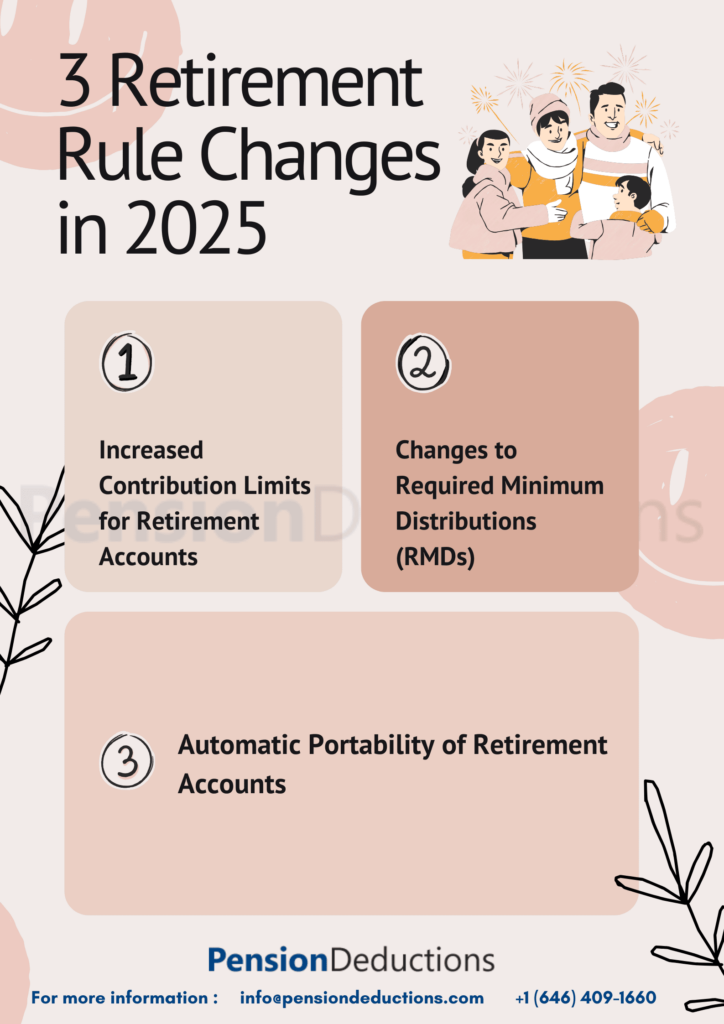

3 Retirement Rule Changes in 2025: What You Need to Know

1. Increased Contribution Limits for Retirement Accounts

One of the most significant retirement rule changes in 2025 is the increase in contribution limits for tax-advantaged accounts like 401(k)s and IRAs.

Key Updates for 2025

401(k) Contribution Limits

IRA Contributions Limits

Traditional and Roth IRA limits will likely see modest increases, allowing individuals to contribute up to $7,000 or $8,000 depending on age.

Impact on Savers

2. Changes to Required Minimum Distributions (RMDs)

RMD Age Increase

In 2024, the RMD age was 73. For 2025, this age is increasing to 74, providing retirees with another year to grow their investments tax-deferred.

For younger savers, the long-term outlook points to an RMD age of 75 by 2033 under the SECURE Act 2.0.

Penalty Reduction

The penalty for missing an RMD has been reduced from 50% to 25%, and even further to 10% if corrected promptly.

Strategies to Optimize RMDs

Roth

Conversions

Qualified Charitable Distributions (QCDs)

Schedule a Free Consultation Now!

3. Automatic Portability of Retirement Accounts

What is Automatic Portability?

Why It Matters?

Prevent Lost

Savings

Reduce Early Withdrawals

How to Prepare

Other Noteworthy Updates for Retirement Rule Changes in 2025

Catch-Up Contributions and Income Thresholds

Expanded Access for Part-Time Workers

FAQs

Conclusion

Pension Deductions is here to help you navigate these changes with expert guidance, tools, and resources. Stay informed and make 2025 the year you maximize your retirement potential.

SHARE THIS POST

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.