Year-End Financial Planning in the USA

From retirement contributions to investment strategies, year-end planning ensures that your finances are in order, helping you achieve your long-term goals.

Why Year-End Financial Planning Matters?

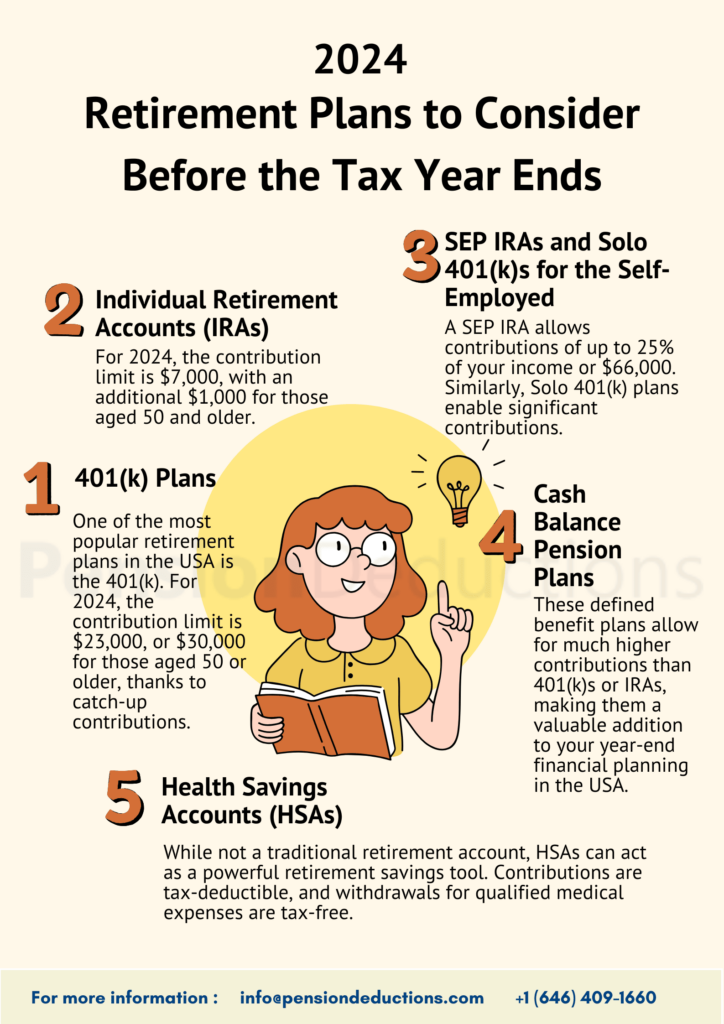

Retirement Plans to Consider Before the Tax Year Ends

401(k) Plans

One of the most popular retirement plans in the USA is the For 2024, the contribution limit is $23,000, or $30,000 for those aged 50 or older, thanks to catch-up contributions. Increasing your 401(k) contributions before December 31 can reduce taxable income and set you on the path to a secure retirement.

Many employers also offer matching contributions, so be sure to contribute enough to take full advantage of this benefit as part of your year-end financial planning in the USA.

Individual Retirement Accounts (IRAs)

Traditional and Roth IRAs are excellent options for boosting retirement savings. For 2024, the contribution limit is $7,000, with an additional $1,000 for those aged 50 and older. Contributions to a Traditional IRA are tax-deductible, making them a vital tool for tax-efficient retirement planning.

For Roth IRAs, although contributions are not deductible, they grow tax-free, making them a smart choice for those expecting to be in a higher tax bracket during retirement.

SEP IRAs and Solo 401(k)s for the Self-Employed

Self-employed individuals have unique opportunities for year-end financial planning in the USA. A SEP IRA .allows contributions of up to 25% of your income or $66,000 (whichever is lower). Similarly, Solo 401(k) plans enable significant contributions, offering both an employee and employer contribution component, making them ideal for maximizing tax-deferred savings.

Cash Balance Pension Plans

For high-income earners looking to defer significant sums of money, cash balance plans are an excellent choice. These defined benefit plans allow for much higher contributions than 401(k)s or IRAs, making them a valuable addition to your year-end financial planning in the USA.

Health Savings Accounts (HSAs)

While not a traditional retirement account, HSAs can act as a powerful retirement savings tool. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. The triple-tax advantage makes HSAs a must-consider option during year-end planning.

Maximize Contributions Before Year-End

Schedule a Free Consultation Now!

Additional Year-End Financial Planning Tips

Harvest Tax Losses

Tax-loss harvesting is a smart strategy for offsetting gains and reducing taxable income. By selling underperforming assets, you can balance out capital gains and potentially reduce what you owe in taxes.

Manage Required Minimum Distributions (RMDs)

If you’re over 73 and hold a Traditional IRA or 401(k), you’re required to take minimum distributions by year-end. Missing this deadline results in hefty penalties, making RMD management a critical aspect of year-end financial planning in the USA.

Charitable Contributions

Donating to qualified charities before the year ends can lower your taxable income while supporting causes you care about.

Flexible Spending Accounts (FSAs)

If you have an FSA, check whether it operates on a “use it or lose it” basis. Plan to use these funds before they expire.

Consult a Financial Advisor

Conclusion

Don’t let the year-end slip by without taking control of your financial destiny. With careful planning, you can set the stage for a prosperous and secure retirement.

SHARE THIS POST

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Explore the evolving retirement expectations 2025, focusing on financial stability, health, and fulfilling aspirations for a rewarding future.

Discover the latest updates to retirement savings contributions in 2025, including higher limits, super catch-up contributions, and strategies to maximize your retirement plan.