The Rule of 55

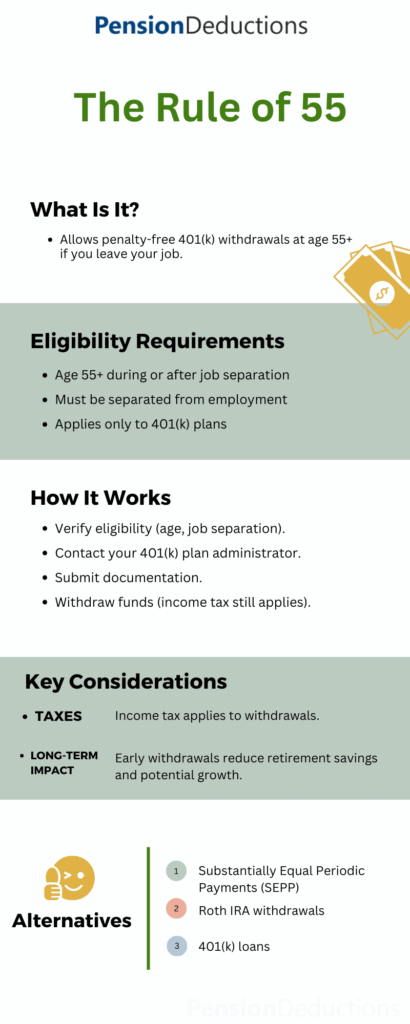

What is the Rule of 55?

Understanding the Basics

Key Considerations

Who Can Benefit from the Rule of 55?

Eligibility Criteria

Age Requirement

You must be at least 55 years old in the year you separate from your employer.

Separation from Service

You must have left your job (whether voluntarily or involuntarily) during or after the year you turn 55.

401(k) Plan

The funds must come from a 401(k) plan sponsored by your employer.

Schedule a Free Consultation Now!

Scenarios where the Rule is helpful

Unexpected Job Loss

If you lose your job unexpectedly, you can access your retirement funds to cover living expenses.

Starting a Business

If you decide to venture into entrepreneurship, you can withdraw funds to invest in your business without facing penalties.

Health Issues

For individuals dealing with health issues, accessing retirement savings can provide financial relief.

How the Rule of 55 works?

Withdrawal Process

Verify Eligibility

Ensure you meet the age and employment separation criteria.

Contact Your Plan Administrator

Reach out to your 401(k) plan administrator to discuss your options for withdrawal.

Submit Necessary Documentation

You may need to provide documentation showing your age and separation from employment.

Withdraw Funds

Once approved, you can withdraw the funds you need.

Tax Implications

Limits on Withdrawals

Planning for Retirement with the Rule of 55

Strategic Considerations

Evaluate Your Financial Needs

Assess how much money you need and how it fits into your overall retirement strategy.

Consider Other Income Sources

Explore other income sources, such as part-time work or passive income, to minimize withdrawals.

Plan for Taxes

Understand the tax implications of your withdrawals and plan accordingly.

Long-Term Impact

Reduced Retirement Savings

Early withdrawals can significantly impact your retirement nest egg.

Future Financial Needs

Be mindful of your future financial needs and how early withdrawals may affect your retirement lifestyle.

Alternatives to the Rule of 55

Other Withdrawal Options

Substantially Equal Periodic Payments (SEPP)

This IRS rule allows individuals to take early withdrawals without penalties, but you must follow specific guidelines.

Roth IRA Withdrawals

Contributions to a Roth IRA can be withdrawn tax-free and penalty-free at any time, though earnings are subject to different rules.

Loans from Your 401(k)

Some plans allow participants to borrow against their 401(k) balance, providing a way to access funds without penalties.

Consulting a Financial Advisor

Schedule a Free Consultation Now!

Conclusion

While it allows penalty-free access to funds, careful planning and consideration of long-term impacts are crucial. Whether you’re navigating unexpected expenses or seeking to invest in a new venture, The Rule of 55 can be a helpful tool in your financial toolkit.

SHARE THIS POST

Explore the IRS Contribution Limits 2025 and learn how inflation adjustments can maximize retirement savings for individuals and employers alike.

Discover the new 401k limits in 2025, maximize your retirement savings, and secure a financially stable future.

Automatic portability of 401k plans in 2025 ensures seamless retirement savings transfers, preserving funds and enhancing financial security across careers.

Uncover how Social Security Reforms 2024 will impact retirees with crucial changes to taxes, benefits, and retirement age adjustments.