The Rule of 72: What it is and How to Calculate it in Investing

What is the Rule of 72?

The formula is simple:

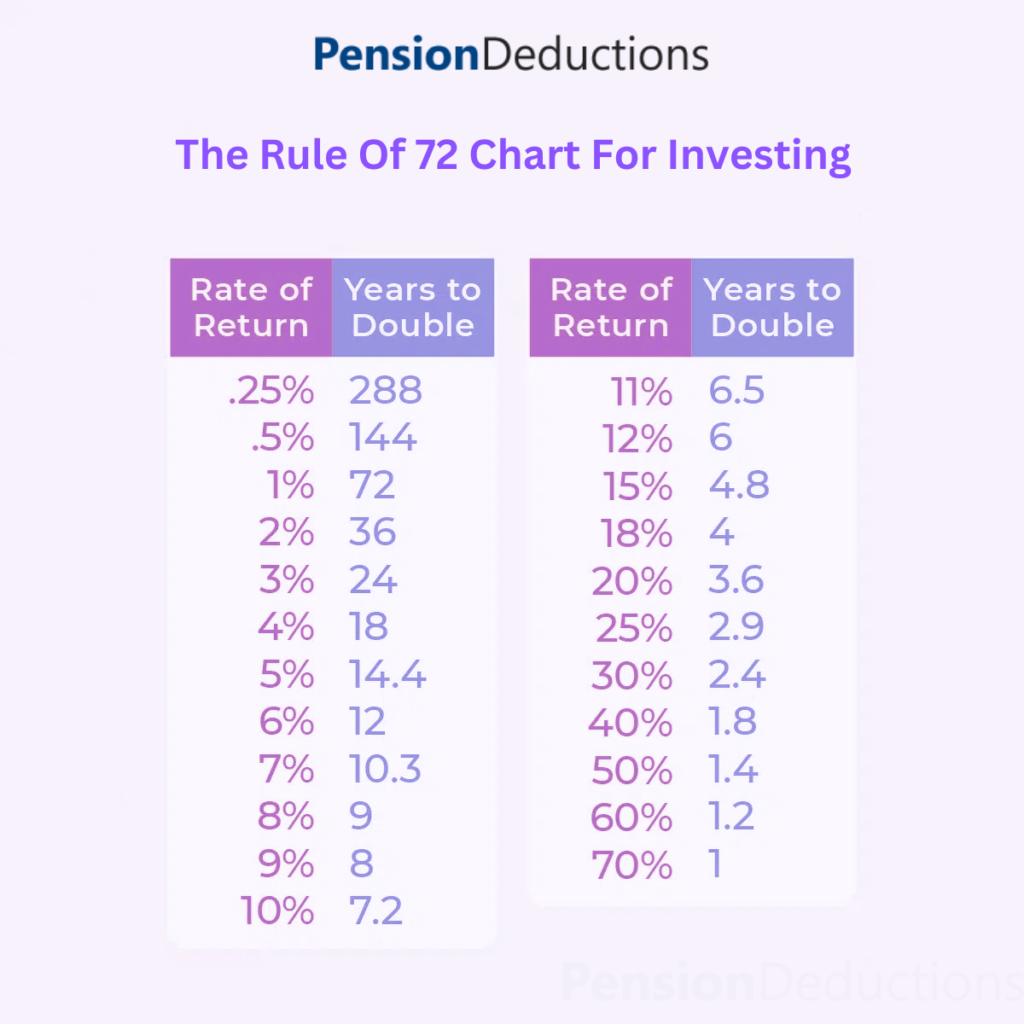

Years to double = 72 Annual Return Rate\text{Years to double} = \frac{72}{\text{Annual Return Rate}}Years to double=Annual Return Rate 72

For example, if you expect an annual return of 8%, using The Rule of 72, it would take approximately 9 years to double your investment:

728=9 years\frac{72}{8} = 9 \text{ years}872=9 years

This easy calculation allows investors to make quick assessments without needing complex financial models.

The History Behind the Rule of 72

The Rule of 72 has stood the test of time due to its simplicity and effectiveness, making it a favorite among both novice and seasoned investors.

How to Calculate the Rule of 72?

Calculating The Rule of 72 is straightforward:

Determine the Expected Annual Return Rate:

This can be based on historical performance, market analysis, or the average return of a particular investment.

Apply the Formula:

Divide 72 by the expected annual return rate.

Scenario 1: Stock Market Investment

Suppose you are investing in the stock market, which historically returns about 10% annually. Applying The Rule of 72:

7210=7.2 years\frac{72}{10} = 7.2 \text{ years}1072=7.2 years

This means your investment would double in approximately 7.2 years.

Scenario 2: Bonds

If you are considering investing in government bonds, which might offer a lower return of around 5%:

725=14.4 years\frac{72}{5} = 14.4 \text{ years}572=14.4 years

Here, it would take about 14.4 years for your investment to double.

Importance of Accuracy

While The Rule of 72 is a useful approximation, the actual time it takes for your investment to double may vary based on market conditions, inflation rates, and other economic factors. Therefore, it is essential to use this rule as a guideline rather than an absolute measure.

Practical Applications of the Rule of 72

Investment Planning

The Rule of 72 can aid in investment planning by helping you set realistic financial goals. For example, if you have a specific timeline for achieving certain financial milestones (like buying a house or funding education), you can use this rule to determine the returns needed on your investments.

Comparing Investment Options

Investors can use The Rule of 72 to compare the potential returns of various investment options. By calculating the time it will take to double your investment in stocks, bonds, mutual funds, or real estate, you can make informed decisions about where to allocate your resources.

Understanding Compound Interest

The Rule of 72 serves as a reminder of the power of compound interest. The longer you invest, the more your money can grow exponentially. By grasping this concept, investors are more likely to appreciate the benefits of starting to invest early.

Schedule a Free Consultation Now!

Limitations of the Rule of 72

Fixed Rate Assumption

The Rule of 72 assumes a constant annual return rate, which is rarely the case in real-life investing. Markets fluctuate, and returns can vary significantly year over year.

Short-Term Investments

The Rule of 72 is more accurate for long-term investments. For short-term investments, the results may not be as reliable due to market volatility.

Does Not Account for Taxes and Fees

The rule does not factor in taxes, fees, or other costs associated with investments, which can significantly impact the actual returns.

The Rule of 72 in Today’s Market

Current Trends in Investing

As of 2024, the investing landscape in the USA is changing. With the rise of alternative investments such as cryptocurrency and real estate crowdfunding, understanding The Rule of 72 becomes even more vital. These investments often come with varied return rates, and calculating potential growth can guide investors in making informed choices.

Interest Rates and Inflation

With current economic conditions, including fluctuating interest rates and inflation, the expected annual returns on investments may shift. For instance, if inflation rates rise, the real return on your investments may decrease, affecting how The Rule of 72 applies.

Seeking Professional Advice

In today’s complex financial environment, many investors may benefit from consulting financial advisors. While The Rule of 72 offers a quick estimation, professional guidance can provide a more comprehensive analysis tailored to individual financial situations.

Conclusion

Incorporating The Rule of 72 into your investment strategy can enhance your financial literacy and help you achieve your financial goals more effectively. Whether you’re a seasoned investor or just starting, understanding this simple formula can significantly impact your financial future. So, the next time you’re evaluating an investment opportunity, don’t forget to apply The Rule of 72 and watch your money grow!

SHARE THIS POST

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.