Tax Planning for Retirement Income

Understanding Tax Planning for Retirement

The Importance of Early Tax Planning

Current Tax Landscape for Retirees

Federal Income Tax Rates

The federal income tax rates remain progressive, meaning that higher income levels are taxed at higher rates. For retirees, this means that income from various sources, including pensions, interest, and dividends, will be taxed differently.

Social Security Taxation

Did you know that up to 85% of your Social Security benefits could be taxable? This is a crucial aspect of tax planning for retirement. It’s essential to understand how your combined income affects your Social Security taxation. By managing your other income sources, you may be able to reduce the tax on your Social Security benefits.

Effective Strategies for Tax Planning for Retirement

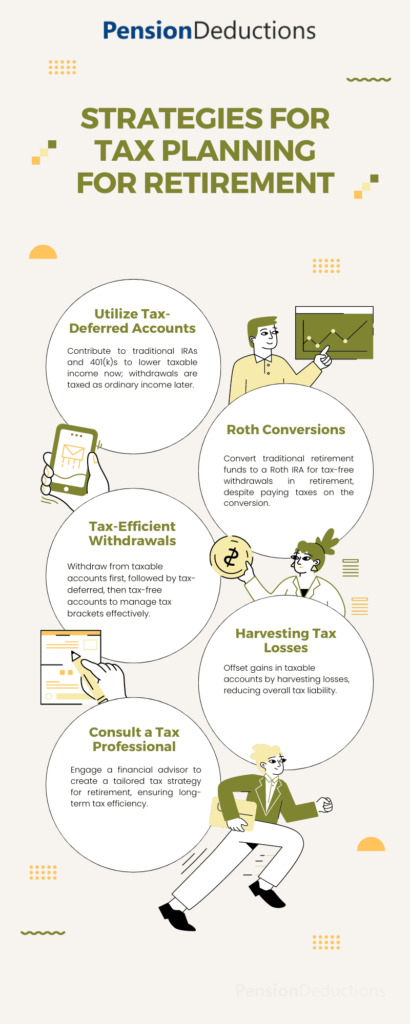

Utilize Tax-Deferred Accounts

One of the most effective strategies in tax planning for retirement is utilizing tax-deferred accounts like traditional IRAs and 401(k)s. Contributions to these accounts reduce your taxable income during your working years. However, keep in mind that withdrawals in retirement are taxed as ordinary income.

Roth Conversions

Consider converting some of your traditional retirement account funds into a Roth IRA. While you’ll pay taxes on the converted amount, qualified withdrawals from a Roth IRA are tax-free in retirement. This strategy can be a game-changer in your tax planning for retirement.

Tax-Efficient Withdrawals

When planning your withdrawals, consider the order in which you take money from your retirement accounts. Generally, it’s advisable to withdraw from taxable accounts first, then tax-deferred accounts, and finally tax-free accounts like Roth IRAs. This approach can help manage your tax brackets effectively.

Harvesting Tax Losses

If you have taxable investment accounts, consider harvesting tax losses to offset gains. This strategy can be beneficial for tax planning for retirement by reducing your overall tax liability.

State Tax Considerations

Understanding State Taxes

Retirees should also consider state taxes, which can vary significantly. Some states do not tax retirement income, while others may tax pensions and Social Security benefits. When engaging in tax planning for retirement, it’s essential to understand your state’s tax laws and how they apply to your retirement income.

Relocation for Tax Benefits

Some retirees choose to relocate to states with more favorable tax climates. This decision can significantly impact your tax planning for retirement strategy and overall financial health.

Schedule a Free Consultation Now!

Don’t Forget About Healthcare Costs

Medicare Premiums

Healthcare is a significant expense in retirement. While Medicare covers many healthcare costs, your premiums may be impacted by your income. Higher-income retirees may face increased premiums. Planning for these costs is essential for effective tax planning for retirement.

Health Savings Accounts (HSAs)

If you are still working and have access to a Health Savings Account (HSA), consider maximizing contributions. HSAs offer triple tax advantages: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. This can be a powerful tool in your tax planning for retirement.

Seeking Professional Guidance

Work with a Tax Advisor

Navigating the complexities of tax planning for retirement can be challenging. Consider working with a tax advisor who understands the intricacies of retirement income and can help you develop a personalized strategy to minimize your tax liability.

Utilize Financial Planning Services

Many financial planning firms offer comprehensive services that include tax planning as part of their retirement planning. A well-rounded approach can ensure all aspects of your financial health are aligned.

Conclusion

SHARE THIS POST

Discover effective tax planning for retirement strategies. Maximize your income, minimize taxes, and secure your financial future today.

Discover how inflation impacts on your retirement income. Learn strategies to safeguard your savings and maintain purchasing power in an uncertain economy.

Top Retirement Planning Strategies for Small Business Owners Planning for retirement can feel like a daunting task, especially when you’re running a small business. As

Discover how a Defined Benefit Plan can significantly reduce your tax liabilities while securing your retirement. Understanding Defined Benefit Plans: Basics and Benefits Defined benefit