403(b) vs. Roth IRA: Understanding Your Investment

In this article, we’ll dive deep into the 403(b) vs. IRA debate and help you make an informed decision on which retirement plan suits your needs.

What is a 403(b) Plan?

Key Features of a 403(b) Plan

Tax-Deferred Contributions:

Contributions are made on a pre-tax basis, reducing your taxable income for the year

Employer Contributions

Many employers offer matching contributions, making the plan even more valuable

Contribution Limits

For 2024, the contribution limit is $23,000 if you're under 50 and $30,500 for those 50 and older (including the $7,500 catch-up contribution)

Investment Options

These plans typically offer fewer investment choices, primarily in mutual funds and annuities

Required Minimum Distributions (RMDs)

You must start taking RMDs at age 73

What is a Roth IRA?

Key Features of a Roth IRA

-

Tax-Free Withdrawals: Since contributions are made with post-tax dollars, withdrawals in retirement are tax-free

-

No RMDs: Roth IRAs do not have required minimum distributions, allowing for more flexibility in your withdrawal strategy

-

Contribution Limits: For 2024, the contribution limit is $6,500 if you're under 50 and $7,500 if you're 50 or older. However, high-income earners may face reduced or zero eligibility

-

Flexible Withdrawals: You can withdraw contributions (not earnings) at any time without penalty

-

Investment Options: Roth IRAs offer a wider range of investment choices, including stocks, bonds, ETFs, and more

403(b) vs. IRA: Key Differences

Tax Treatment

403(b)

Contributions are tax-deferred, meaning you won’t pay taxes until you withdraw the money in retirement

Roth IRA

Contributions are made with after-tax dollars, allowing for tax-free growth and tax-free withdrawals in retirement

Contribution Limits

403(b)

The contribution limit for a 403(b) is significantly higher ($23,000 for those under 50, and $30,500 for those 50 and older). If your employer offers matching contributions, the total contribution limit can be even higher

Roth IRA

Roth IRAs have lower contribution limits ($6,500 for those under 50, $7,500 for those over 50)

Employer Contributions

403(b)

Employer matching contributions are common in 403(b) plans, making them attractive for those working for eligible organizations

Roth IRA

There are no employer contributions in a Roth IRA since it is an individual account

Income Eligibility

403(b)

There are no income restrictions for contributing to a 403(b) plan. Anyone who works for an eligible employer can participate

Roth IRA

Roth IRAs have income eligibility restrictions. For 2024, single filers with a modified adjusted gross income (MAGI) above $153,000 and married couples filing jointly with a MAGI above $228,000 cannot contribute to a Roth IRA

Investment Options

403(b)

These plans typically offer limited investment options, usually in the form of mutual funds or annuities

Roth IRA

Roth IRAs offer a broader range of investments, including individual stocks, bonds, mutual funds, and ETFs, providing more flexibility

Required Minimum Distributions (RMDs)

403(b)

Like all tax-deferred retirement plans, a 403(b) plan requires you to start taking required minimum distributions (RMDs) at age 73

Roth IRA

Roth IRAs have no RMDs during the account owner’s lifetime, allowing you to let your savings grow indefinitely

Schedule a Free Consultation Now!

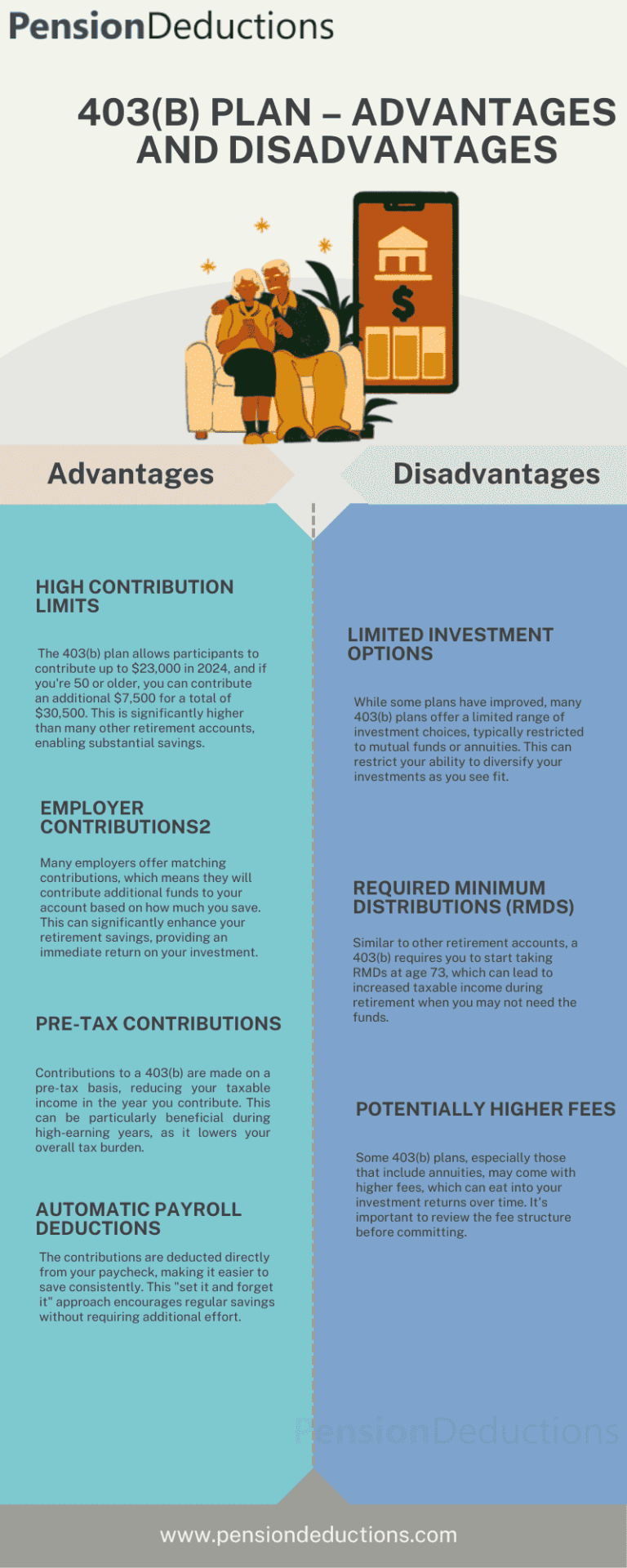

403(b) vs. IRA: Advantages and Disadvantages

403(b)

Advantages

-

High Contribution Limits:

The ability to contribute up to $30,500 if you're 50 or older allows you to save significantly more each year -

Employer Match:

Many 403(b) plans offer employer-matching contributions, providing an immediate return on your investment -

Pre-Tax Contributions:

By making pre-tax contributions, you can reduce your taxable income in the years you're working

Disadvantages

-

Limited Investment Options:

With fewer investment options, you may not have as much control over where your money goes -

RMDs:

You are required to take minimum distributions starting at age 73, which could increase your taxable income in retirement -

Fees:

403(b) plans can sometimes come with higher fees, particularly if annuities are involved

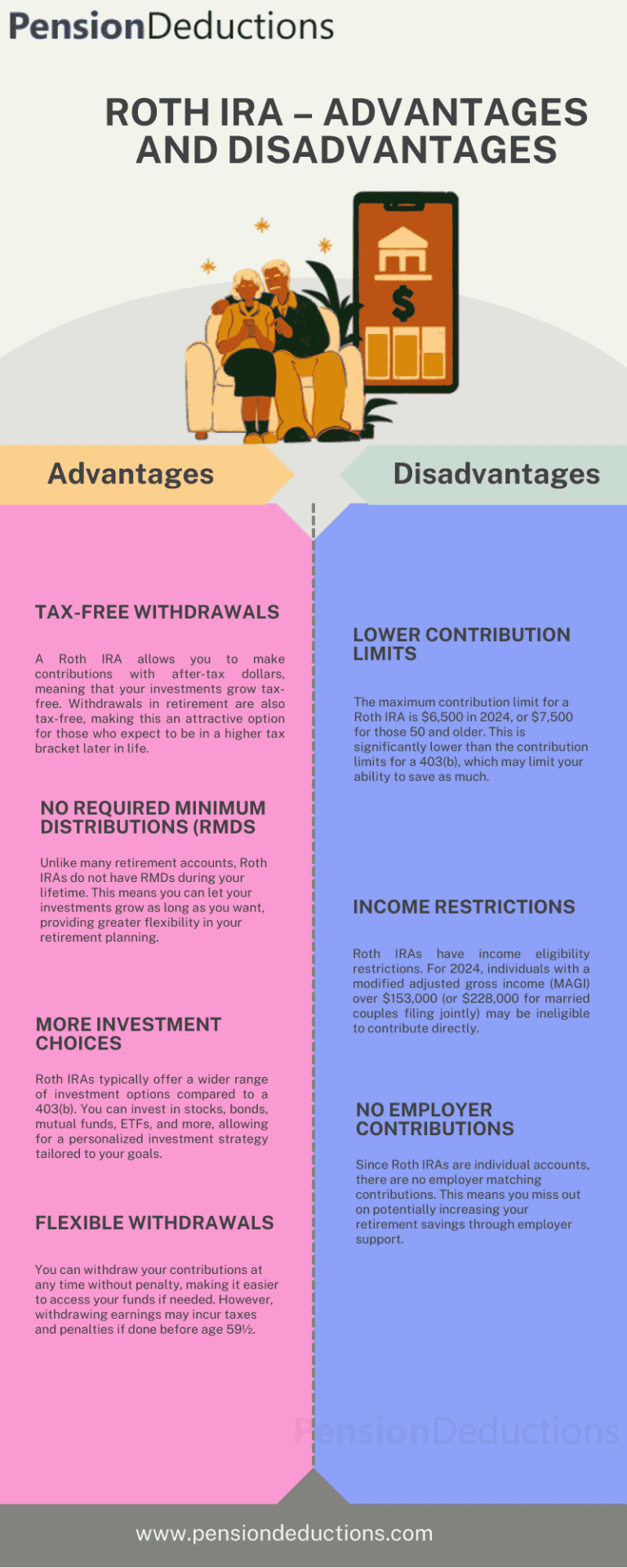

Roth IRA

Advantages

-

Tax-Free Withdrawals:

The biggest benefit of a Roth IRA is the ability to make tax-free withdrawals in retirement -

No RMDs:

Roth IRAs allow you to let your money grow without the pressure of mandatory withdrawals -

Wide Range of Investment Options:

With the ability to invest in a variety of assets, you have more control over your retirement strategy

Disadvantages

-

Lower Contribution Limits:

With a maximum contribution limit of $6,500 for those under 50, it can be harder to save significant amounts in a Roth IRA -

Income Restrictions:

High-income earners may not be able to contribute to a Roth IRA

Choosing Between 403(b) and Roth IRA: What’s Best for You?

Employer Contributions

If your employer offers a match in your 403(b), it may make sense to contribute enough to get the full match before putting money in a Roth IRA

Income

If you're a high earner, you may not be eligible for a Roth IRA. In this case, a 403(b) plan could be your best option

Tax Strategy

If you expect to be in a higher tax bracket during retirement, a Roth IRA's tax-free withdrawals could be more beneficial

Conclusion

Ultimately, the best choice depends on your income, employment status, and retirement goals. You may even find that a combination of both accounts works best for your financial future. Consider consulting with a financial advisor to develop a retirement plan that suits your unique situation.

SHARE THIS POST

Learn the key differences between a 403(b) and Roth IRA in this comprehensive guide. Discover tax benefits, contribution limits, and investment options for your retirement plan.

Discover top tax strategies for retirement income to maximize financial efficiency. Learn how to manage withdrawals, leverage Roth IRAs, and more.

Understanding the Cash Balance Plan A Cash Balance Plan is a type of defined benefit plan that acts similarly to a defined contribution plan. Employers