Maximizing Your Tax Savings with Cash Balance Pension Plans

When it comes to planning for retirement, maximizing tax savings is a smart move. One of the most effective ways to achieve this is through a Cash Balance Pension Plan. If you’re self-employed, a small business owner, or simply looking to supercharge your retirement savings while enjoying significant tax benefits, this guide will walk you through the Cash Balance Pension Plan tax advantages and how you can make the most of them.

What is a Cash Balance Pension Plan?

First things first, let’s demystify the Cash Balance Pension Plan. Unlike a traditional pension plan, which provides a fixed monthly income in retirement, a Cash Balance Plan combines elements of both defined benefit and defined contribution plans. Think of it as a hybrid – you get the predictability of a pension with some of the flexibility of a 401(k).

In a Cash Balance Plan, you accumulate a “cash balance” that grows annually with a guaranteed interest rate. This balance can be converted into an annuity or taken as a lump sum upon retirement. It’s like having a savings account where your balance is guaranteed to grow – and it comes with some fantastic tax perks.

In a Cash Balance Plan, you accumulate a “cash balance” that grows annually with a guaranteed interest rate. This balance can be converted into an annuity or taken as a lump sum upon retirement. It’s like having a savings account where your balance is guaranteed to grow – and it comes with some fantastic tax perks.

The Tax Advantages of Cash Balance Pension Plans

Significant Tax Deductions

Tax-Deferred Growth

Reducing Your Current Tax Bill

Flexibility in Contributions

Enhanced Retirement Security

Significant Tax Deductions

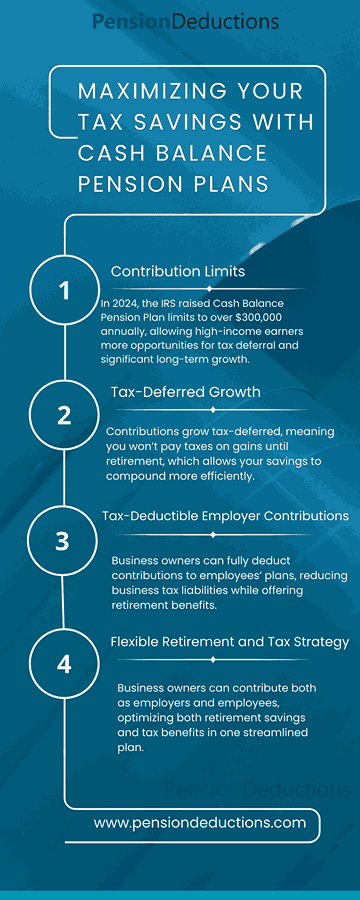

One of the most appealing features of a Cash Balance Plan is the ability to make substantial tax-deductible contributions. Unlike 401(k)s, where contribution limits are relatively modest, Cash Balance Plans allow for much higher contribution limits. This is particularly advantageous for high-income earners looking to reduce their taxable income.

For instance, in 2024, the maximum contribution to a Cash Balance Plan can exceed $200,000 per year depending on your age and income. This means if you’re making a hefty income, you can potentially lower your taxable income by a substantial amount, leading to significant tax savings.

For instance, in 2024, the maximum contribution to a Cash Balance Plan can exceed $200,000 per year depending on your age and income. This means if you’re making a hefty income, you can potentially lower your taxable income by a substantial amount, leading to significant tax savings.

Tax-Deferred Growth

Another major advantage is tax-deferred growth. The money you contribute to a Cash Balance Plan grows without being taxed until you withdraw it. This allows your investments to compound over time without the immediate burden of taxes. It’s like having a financial turbocharger that accelerates your growth without the drag of annual tax hits.

Imagine you’re investing $50,000 annually into your Cash Balance Plan. Over the years, that money can grow significantly due to the compounding effect. If it were subject to annual taxation, that growth would be slowed down by the tax drag. With tax-deferred growth, your investments have more room to expand.

Imagine you’re investing $50,000 annually into your Cash Balance Plan. Over the years, that money can grow significantly due to the compounding effect. If it were subject to annual taxation, that growth would be slowed down by the tax drag. With tax-deferred growth, your investments have more room to expand.

Reducing Your Current Tax Bill

By making large contributions to a Cash Balance Plan, you can drastically reduce your current tax bill. Since contributions are tax-deductible, they directly lower your taxable income for the year. This can be a game-changer for those in high tax brackets.

Consider this: if you’re in a 35% tax bracket and contribute $100,000 to your Cash Balance Plan, you could potentially save $35,000 in taxes for that year. That’s a substantial reduction that can be used to reinvest or cover other expenses.

Consider this: if you’re in a 35% tax bracket and contribute $100,000 to your Cash Balance Plan, you could potentially save $35,000 in taxes for that year. That’s a substantial reduction that can be used to reinvest or cover other expenses.

Flexibility in Contributions

Cash Balance Plans offer flexibility in how contributions are structured. While traditional pension plans might require fixed contributions, Cash Balance Plans can be designed to fit your financial situation. This flexibility is particularly useful for business owners who may experience fluctuating income.

Let’s say your business has a banner year, and you want to take advantage of this by making a larger contribution. Cash Balance Plans can accommodate this, allowing you to make substantial contributions when your cash flow allows.

Let’s say your business has a banner year, and you want to take advantage of this by making a larger contribution. Cash Balance Plans can accommodate this, allowing you to make substantial contributions when your cash flow allows.

Enhanced Retirement Security

Beyond tax advantages, Cash Balance Plans provide enhanced retirement security. Since they come with a guaranteed interest rate and a defined benefit, you can enjoy a predictable income stream in retirement. This stability is a valuable complement to other retirement savings and investment accounts, providing a safety net for your future.

Imagine having a retirement plan where you know exactly how much you’ll receive each month, regardless of market fluctuations. That’s the peace of mind a Cash Balance Plan can offer.

Imagine having a retirement plan where you know exactly how much you’ll receive each month, regardless of market fluctuations. That’s the peace of mind a Cash Balance Plan can offer.

Conclusion

Maximizing your tax savings with a Cash Balance Pension Plan can be a highly effective strategy for boosting your retirement savings while enjoying significant tax benefits. With the ability to make substantial tax-deductible contributions, benefit from tax-deferred growth, and reduce your current tax bill, it’s a powerful tool for high-income earners and business owners alike.

Whether you’re looking to enhance your retirement security or reduce your taxable income, a Cash Balance Plan offers a compelling solution. By understanding and leveraging these tax advantages, you can take proactive steps toward a more secure and financially secure retirement.

Whether you’re looking to enhance your retirement security or reduce your taxable income, a Cash Balance Plan offers a compelling solution. By understanding and leveraging these tax advantages, you can take proactive steps toward a more secure and financially secure retirement.

SHARE THIS POST

Related Blogs

Generation X and Retirement

Generation X and Retirement: Discover smart strategies to avoid costly mistakes and secure your future with effective financial planning.

Shrideep Murthy

April 7, 2025

9:15 pm

Defined Benefit Plan vs 401k: Best Pension Plans for Small Business Owners

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Shrideep Murthy

February 25, 2025

2:48 pm

How Small Business Owners Can Save Up to $300,000 in Taxes with a Pension Plan

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Shrideep Murthy

February 17, 2025

9:15 pm

The Ultimate Guide to Using a Cash Balance Plan Calculator in 2025

Effectively use Cash Balance Plan calculator in 2025 to optimize your retirement savings and financial planning. To know more contact us!

Shrideep Murthy

January 28, 2025

10:05 pm