Sustainability and Funding in Defined Benefit Plans

Defined Benefit Plans

have long been a cornerstone of retirement security for millions of Americans. However, the sustainability and funding of these plans are increasingly under scrutiny. As we move further into 2024, the challenges of maintaining these plans are becoming more pronounced. This blog will explore the key issues surrounding the Sustainability and Funding in Defined Benefit Plan, providing insights into the hurdles faced by plan sponsors and the strategies being employed to ensure the longevity of these vital retirement vehicles.

Understanding Sustainability and Funding in Defined Benefit Plans

Understanding Defined Benefit Plans

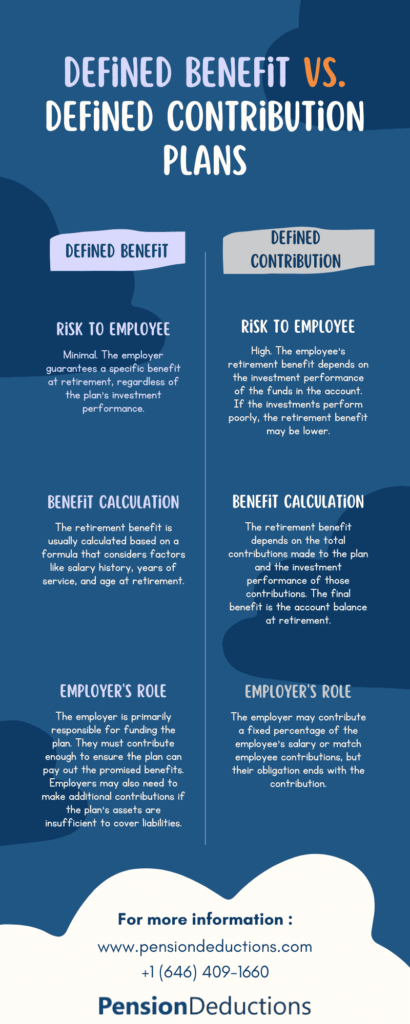

Defined Benefit Plans promise a specified monthly benefit at retirement, often based on a formula that considers salary history and duration of employment. These plans differ significantly from Defined Contribution Plans, where the contributions are defined but the benefit amount depends on investment performance. In a Defined Benefit Plans, the employer bears the investment risk, making the Sustainability and Funding in Defined Benefit Plan a critical topic of discussion. You can also calculate your contribution using the help of our unique Defined Benefit Plan Calculator.

Sustainability Challenges in Defined Benefit Plans

One of the most significant challenges in maintaining the Sustainability and Funding in Defined Benefit Plan is demographic shifts. As life expectancy increases, retirees are drawing benefits for longer periods, placing additional strain on plan assets. Additionally, the aging workforce means a growing number of retirees relative to active workers, further complicating the funding dynamics.

Another major concern is the volatility of investment returns. Defined Benefit Plans rely heavily on investment income to meet their long-term obligations. However, market fluctuations can lead to funding shortfalls, especially when investment returns fall short of expectations. This unpredictability in returns can severely impact the Sustainability and Funding in Defined Benefit Plan.

Another major concern is the volatility of investment returns. Defined Benefit Plans rely heavily on investment income to meet their long-term obligations. However, market fluctuations can lead to funding shortfalls, especially when investment returns fall short of expectations. This unpredictability in returns can severely impact the Sustainability and Funding in Defined Benefit Plan.

Funding Challenges in Defined Benefit Plans

The funding of Defined Benefit Plans is complex and requires careful management. Employers must make regular contributions to the plan based on actuarial calculations . These calculations consider factors such as employee demographics, expected returns on investments, and future benefit payments. However, in recent years, many plans have struggled to maintain adequate funding levels.

A key issue affecting the Sustainability and Funding in Defined Benefit Plan is the low-interest-rate environment that has persisted over the last decade. Lower interest rates increase the present value of future liabilities, requiring higher contributions from employers to keep the plan fully funded. This has led to significant funding gaps in many plans, forcing employers to either increase contributions or seek alternative solutions.

A key issue affecting the Sustainability and Funding in Defined Benefit Plan is the low-interest-rate environment that has persisted over the last decade. Lower interest rates increase the present value of future liabilities, requiring higher contributions from employers to keep the plan fully funded. This has led to significant funding gaps in many plans, forcing employers to either increase contributions or seek alternative solutions.

Regulatory and Legislative Responses

To address the Sustainability and Funding in Defined Benefit Plan, various regulatory and legislative measures have been introduced. The Pension Protection Act (PPA) of 2006, for example, established stricter funding requirements and imposed penalties on underfunded plans. More recently, the SECURE 2.0 Act . Act has introduced provisions aimed at strengthening retirement security, including measures that could impact Defined Benefit Plans.

Despite these efforts, many plans continue to face significant funding challenges. The role of government-sponsored programs, such as the Pension Benefit Guaranty Corporation (PBGC), has become increasingly important. The PBGC provides a safety net for participants in underfunded plans but is itself facing financial difficulties, raising concerns about its ability to fulfill its obligations in the long term.

Despite these efforts, many plans continue to face significant funding challenges. The role of government-sponsored programs, such as the Pension Benefit Guaranty Corporation (PBGC), has become increasingly important. The PBGC provides a safety net for participants in underfunded plans but is itself facing financial difficulties, raising concerns about its ability to fulfill its obligations in the long term.

Strategies for Enhancing Sustainability and Funding

Given the challenges, it’s clear that innovative strategies are needed to ensure the Sustainability and Funding in Defined Benefit Plan. One approach is the adoption of liability-driven investing (LDI), which focuses on aligning the investment strategy with the plan’s liabilities. By reducing the mismatch between assets and liabilities, LDI can help stabilize funding levels and reduce the risk of shortfalls.

Another strategy involves the use of pension risk transfer (PRT) solutions, such as annuity buyouts and buy-ins. These solutions allow employers to transfer some or all of the plan’s liabilities to an insurance company, thereby reducing the plan’s exposure to investment and longevity risks. While PRT can be an effective way to manage risks, it also requires careful consideration of the costs and implications for plan participants.

Plan sponsors are also exploring ways to increase contributions and improve plan governance. This includes re-evaluating the plan’s funding policy, enhancing investment oversight, and exploring opportunities for cost-sharing with employees. By taking a proactive approach, sponsors can help ensure the Sustainability and Funding in Defined Benefit Plan for the long term.

Another strategy involves the use of pension risk transfer (PRT) solutions, such as annuity buyouts and buy-ins. These solutions allow employers to transfer some or all of the plan’s liabilities to an insurance company, thereby reducing the plan’s exposure to investment and longevity risks. While PRT can be an effective way to manage risks, it also requires careful consideration of the costs and implications for plan participants.

Plan sponsors are also exploring ways to increase contributions and improve plan governance. This includes re-evaluating the plan’s funding policy, enhancing investment oversight, and exploring opportunities for cost-sharing with employees. By taking a proactive approach, sponsors can help ensure the Sustainability and Funding in Defined Benefit Plan for the long term.

The Future of Defined Benefit Plans

As we look to the future, the Sustainability and Funding in Defined Benefit Plan will continue to be a critical issue. While Defined Benefit Plans remain an essential part of the retirement landscape, their viability depends on the ability of plan sponsors to adapt to changing economic conditions and demographic trends.

The ongoing challenge will be to balance the needs of retirees with the financial realities faced by employers. This will require innovative solutions, strong governance, and continued support from policymakers. By addressing these challenges head-on, we can help ensure that Defined Benefit Plans remain a viable option for providing retirement security in the years to come.

The ongoing challenge will be to balance the needs of retirees with the financial realities faced by employers. This will require innovative solutions, strong governance, and continued support from policymakers. By addressing these challenges head-on, we can help ensure that Defined Benefit Plans remain a viable option for providing retirement security in the years to come.

Conclusion

The Sustainability and Funding in Defined Benefit Plan is a complex and multifaceted issue that requires careful attention from plan sponsors, regulators, and policymakers. By understanding the challenges and adopting proactive strategies, we can help ensure that Defined Benefit Plans continue to provide valuable retirement benefits to millions of Americans.

SHARE THIS POST

Related Blogs

IRS Contribution Limits 2025: What You Need to Know

Read More »

Explore the IRS Contribution Limits 2025 and learn how inflation adjustments can maximize retirement savings for individuals and employers alike.

Shrideep Murthy

December 10, 2024

9:15 pm

Retirement in USA

Read More »

Planning for retirement in USA involves Social Security, inflation strategies, and choosing the best states, ensuring a secure financial future.

Shrideep Murthy

November 6, 2024

9:15 pm

Best Strategies to Maximize Your 401k

Read More »

Learn effective strategies to maximize your 401k for a secure retirement. Discover tips on matching, investment choices, and catch-up contributions!

Shrideep Murthy

October 23, 2024

9:15 pm

403b Vs 401k: Which is Better for Retirement?

Read More »

Explore the key differences between 403b vs 401k plans. Understand their features, benefits, and who should choose each for optimal retirement savings.

Shrideep Murthy

October 21, 2024

9:15 pm