Automatic Enrollment & Escalation 401(k) Plans

When it comes to securing a comfortable retirement, participation in employer-sponsored 401(k) plans is critical. However, many employees either delay signing up or fail to contribute enough to meet their retirement goals. Enter Automatic Enrollment & Escalation in 401(k) Plans —two powerful tools that are reshaping the retirement savings landscape. These features help ensure that employees are saving adequately, often without needing to take any action themselves.

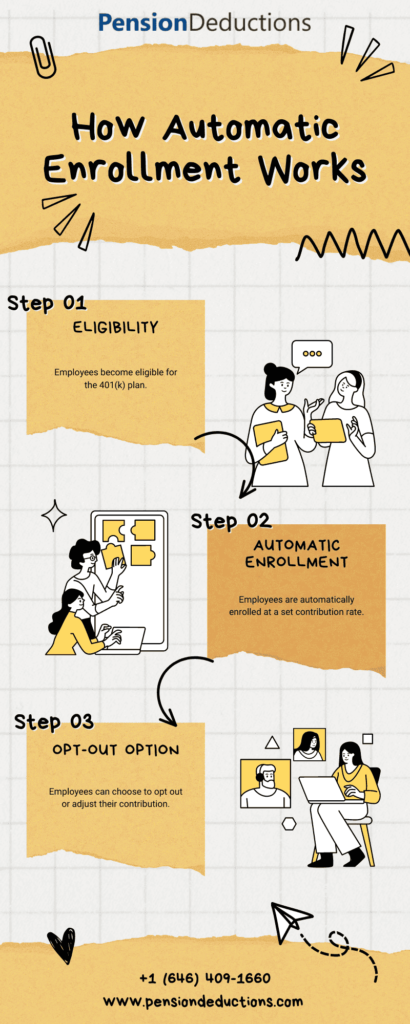

What is Automatic Enrollment?

Automatic Enrollment is a feature that automatically signs up employees for a 401(k) plan when they become eligible, unless they opt out. Instead of requiring employees to opt in, they are automatically enrolled at a pre-determined contribution rate. This approach significantly boosts participation rates, as it eliminates the inertia that often prevents people from enrolling. Moreover, Automatic Enrollment & Escalation in 401k Plans simplifies the enrollment process, reducing the decision-making burden on employees, and helps ensure that more workers are taking advantage of employer-sponsored retirement benefits from the start.

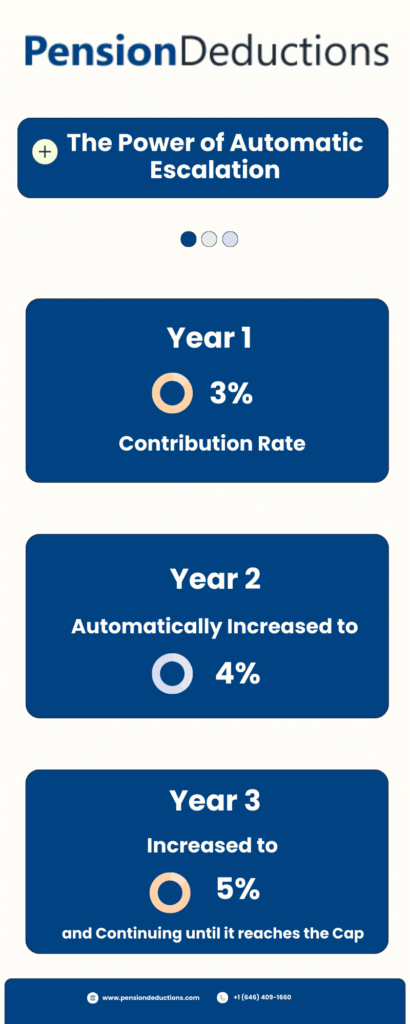

What is Automatic Escalation?

Automatic Enrollment is a feature that gradually increases an employee’s contribution rate over time, typically by 1% annually until it reaches a preset cap (e.g., 10% or 15%). This feature is particularly beneficial because it helps employees increase their savings without feeling the immediate financial impact. By automating the process of increasing contributions, employees are more likely to stay on track with their retirement goals, making consistent progress without the need for frequent adjustments. Additionally, this gradual increase aligns with typical salary growth, minimizing the perceived reduction in take-home pay.

The Benefits of Automatic Enrollment & Escalation in 401(k) Plans

Increased Participation Rates

Studies have shown that Automatic Enrollment & Escalation in 401(k) Plans can significantly increase the participation rate, often boosting it to over 90%. This is crucial for employees who might otherwise delay saving for retirement.

Higher Savings Over Time

Automatic Enrollment & Escalation in 401(k) Plans helps employees increase their savings rates without actively managing their contributions. This gradual increase can lead to a substantial retirement nest egg, as small annual increments compound over time.

Reduced Decision Fatigue

Many employees are overwhelmed by the decisions associated with retirement planning. Automatic Enrollment & Escalation in 401(k) Plans features reduce the number of decisions they need to make, making it easier to stay on track with their savings.

Challenges and Considerations for Automatic Enrollment & Escalation in 401(k) Plans

While Automatic Enrollment & Escalation in 401(k) Plans are highly effective, there are some challenges to consider:

Employee Awareness

Some employees may not be fully aware that they’ve been automatically enrolled or that their contribution rate is increasing. Clear communication is key to ensuring employees understand these features and how they benefit them

Opt-Out Rates

Although participation rates are generally high, there is still a small percentage of employees who opt out. Employers should strive to understand and address the reasons behind opt-outs

Contribution Caps

Setting appropriate caps for automatic escalation is important. Caps that are too low may not provide sufficient retirement savings, while caps that are too high might strain employees’ finances in the short term

Conclusion

Automatic Enrollment & Escalation in 401(k) Plans are game-changers in the world of 401(k) plans. By removing barriers to participation and encouraging higher savings rates, these features help employees build the financial security they need for retirement. As more employers adopt these features, the impact on retirement readiness across the workforce will be profound.

Are you ready to take your 401(k) plan to the next level?

Contact us today to learn how automatic enrollment and escalation can benefit your employees and your business.

Contact us today to learn how automatic enrollment and escalation can benefit your employees and your business.

SHARE THIS POST

Related Blogs

Increase in Social Security Benefits, April 2025

Read More »

Millions of retirees will see increased Social Security Benefits in April 2025 due to WEP and GPO eliminations—learn how it impacts you!

Shrideep Murthy

April 1, 2025

9:15 pm

Defined Benefit Plan vs 401k: Best Pension Plans for Small Business Owners

Read More »

Discover the key differences between a Defined Benefit Plan vs 401k, and find the best pension plan for small business owners.

Shrideep Murthy

February 25, 2025

2:48 pm

How Small Business Owners Can Save Up to $300,000 in Taxes with a Pension Plan

Read More »

Learn how pension plans for small business owners can help save up to $300,000 annually in taxes with maximum deductions.

Shrideep Murthy

February 17, 2025

9:15 pm

Retirement Trends to Watch in 2025

Read More »

Explore the latest Retirement Trends in 2025, including 401(k) updates, automatic portability, and inflation-resistant strategies, to secure your future.

Shrideep Murthy

January 2, 2025

9:15 pm